Companies offering fleet management systems in North America continue to apply different strategies to provide their solutions to the marketplace both before and after the instruction of ELD.

Of course, a number of new companies entered the marketplace for some quick revenue, but they could not be sustained, since their solution did not meet the ELD rulemaking.

Of course, a number of new companies entered the marketplace for some quick revenue, but they could not be sustained, since their solution did not meet the ELD rulemaking.

We have seen some real life examples of vendors exiting…Some ELD vendors continue to be vertically integrated with activities spanning hardware design, software development, marketing, sales, project implementation and system operation. Others use contract manufacturers as an alternative to in-house production.

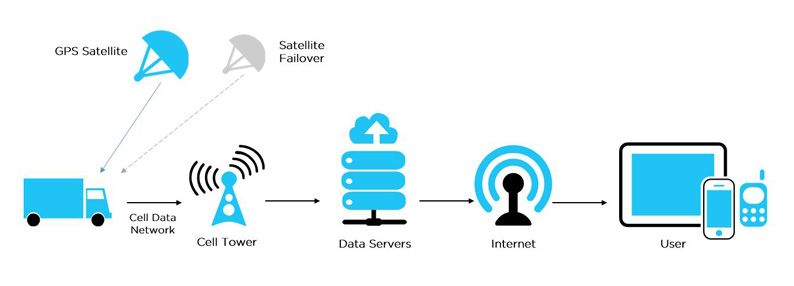

Other vendors use off-the-shelf hardware devices, purchased from external suppliers. Telematics hardware has in general started to be seen as more of a commodity among fleet management solution providers, which are becoming increasingly hardware-agnostic.

The strategic advantages are, to a greater extent, found in onboard and back office software functionality. The solution providers are often supporting a wider range of hardware alternatives.

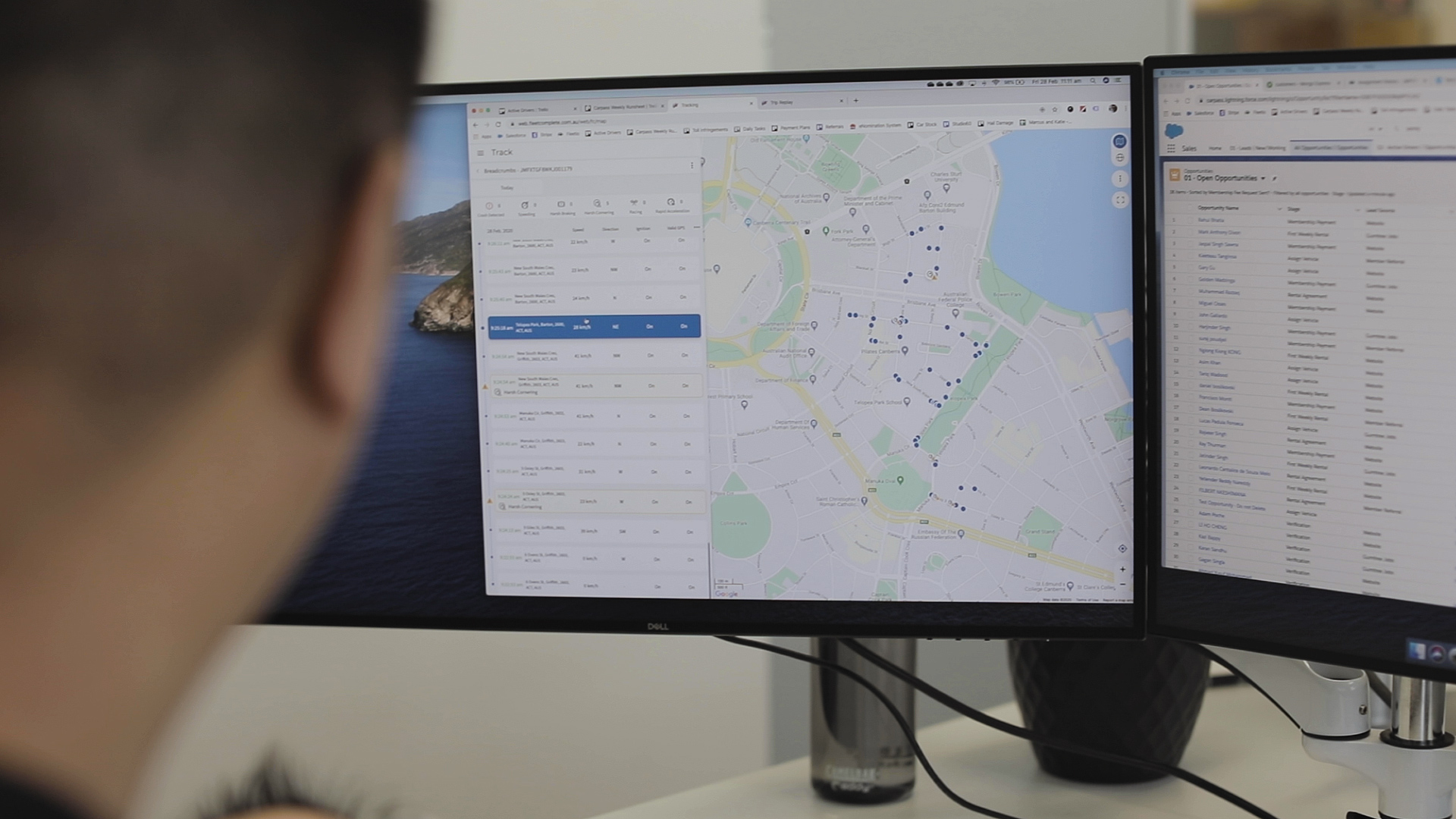

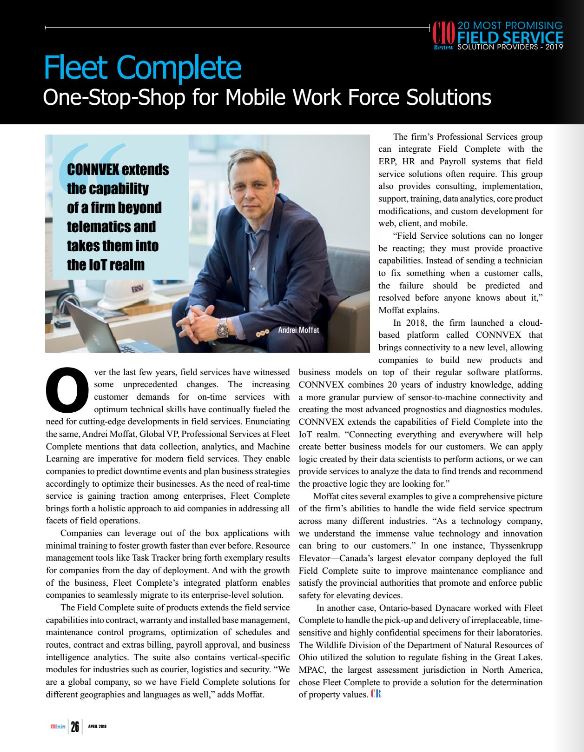

Direct sales remains a principal distribution model among the high-end fleet management solution providers, such as Fleet Complete, while indirect channels are also used for distributing solutions to smaller clients.

Some Mobile ELD vendors have, for example, started to play an important role as distributors of fleet management solutions on many markets – in many cases, using their own branding – including the North American market.

Collaborating with resellers was common when solution providers expanded to service the ELD market. By collaborating with local vendors, access to already established distribution networks were achieved in a timelier manner than otherwise possible. This strategy has been used by several vendors in North America.

Furthermore, online sales models are successfully applied, especially for solutions targeting small fleets. The telematics hardware vendors generally have an international market focus, as opposed to just the U.S., they continue to offer products for both private cars (e.g. vehicle security) and commercial vehicle applications.

These vendors often have a number of distribution channels, ranging from direct sales to end-users, to indirect sales via fleet management and other telematics service providers, system integrators or OEMs. When it comes to completely customer-defined fleet management solutions, system integrators can play an important role.

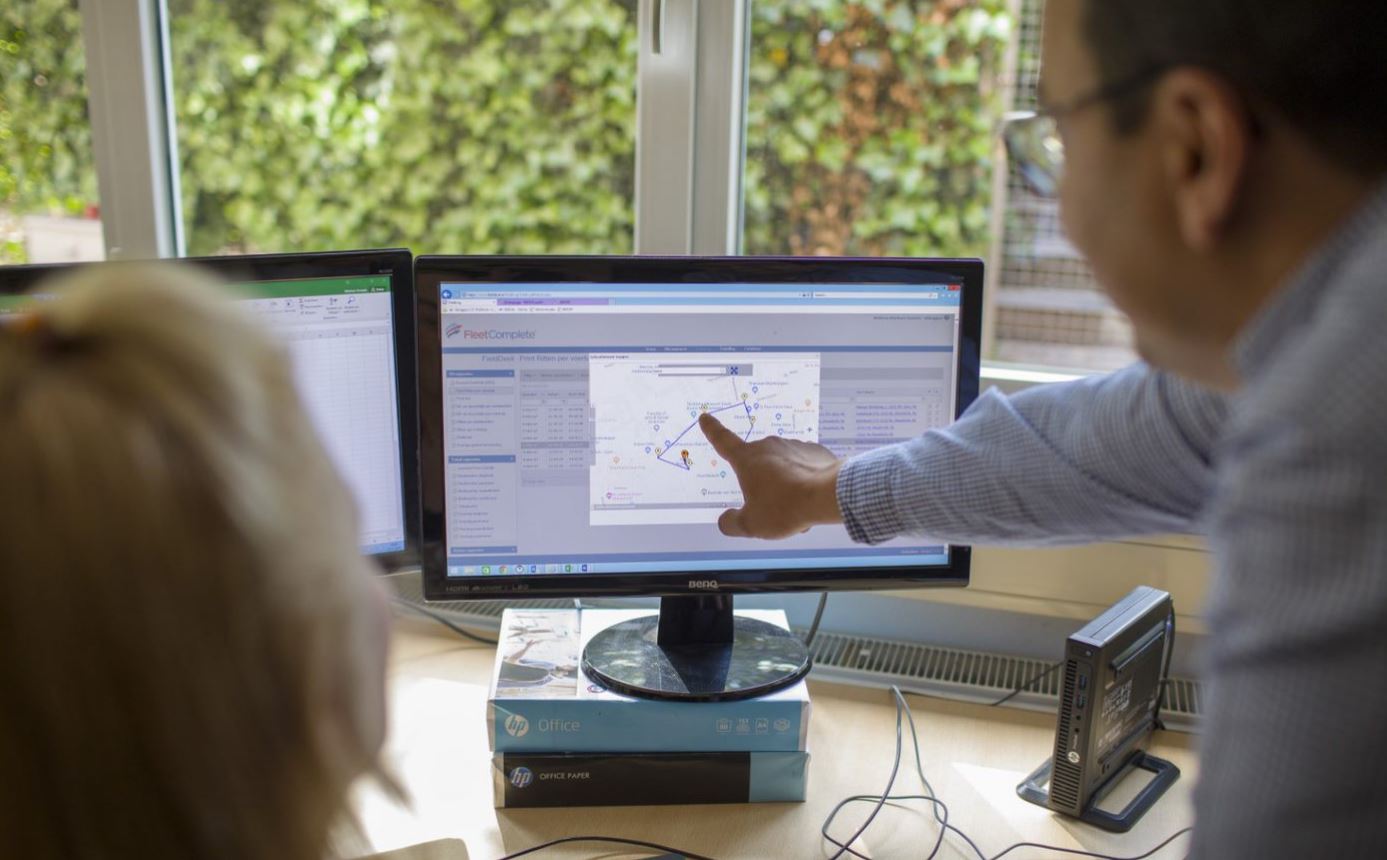

Some vendors, such as Fleet Complete, even choose to develop and host their own fleet management solutions, using components like hardware from external vendors together with their own proprietary software or FM applications from various telematics players.

You also witnessed a series of acquisitions in the marketplace, including Fleet Complete’s acquisition of BigRoad, which is based in Canada and offers the most comprehensive and affordable solution for hours-of-service (HOS) and electronic logging device (ELD) compliance in North America.

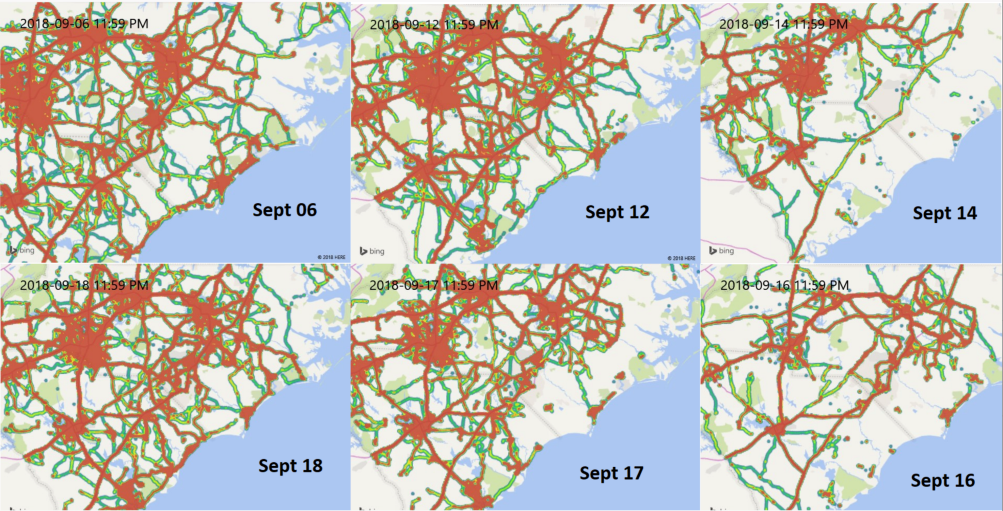

Since the ELD hard-mandate went into effect in December 2018, the overall trucking capacity has increased by 4%. This means that today there are 4% more drivers in the for-hire market available for dispatch than there were on April 1st.

Therefore, the fear that ELD would drive carriers out of the industry is simply not the case. The same goes for motor carriers leaving the industry.

The discussion around a driver “shortage” is incomplete. Somehow, the industry managed to add new drivers, even with all of the difficulties in doing so.

This, of course, doesn’t mean that the environment for hiring drivers isn’t difficult: it clearly is. It just means that carriers have figured out a way, combination of creative solutions and higher pay is being rewarded with new drivers into the industry.

How is the trucking telematics business changing now that virtually everyone who needs an ELD has installed one?

Based on my knowledge of the telematics industry, the pricing models vary among the FM providers. The traditional model includes a combination of upfront hardware and installation costs coupled with service charges for software access.

Hardware prices typically range from around $20 to $30 per unit or even less for basic tracking devices, and up to $40 to $50 per unit for bundled pricing high-end on-board hardware. Back office service models have historically moved from enterprise software licenses towards subscription contracts charged per vehicle using a Software-as-a-Service (SaaS) model.

Monthly subscription fees are dependent on the functionality included. Lower recurring fees have also emerged for entry-level offerings. End-customers are generally offered a complete solution that includes data storage, application hosting, SIM-cards and mobile data communications. Hardware rental or leasing plans are commonly offered in order to minimize the initial cost for the customer.

There is even an increasing share of solution vendors bundling all costs including hardware, installation and software services into subscriptions based on a monthly recurring fee.

This model – sometimes referred to as Solution-as-a-Service or Software-and-Hardware-as-a-Service (SHaaS) – has initially been more common for low- to mid-end systems, based on comparatively simple hardware, but has become increasingly adopted among high-end solution providers.

With the hardware and software sales, additional revenue sources among fleet management solution providers comprise project management, integration support and other consultancy services.

A possible next step in terms of pricing model innovation that may surface as an emerging trend in the fleet management industry is profit-sharing agreements, where a percentage of the end-user cost savings is used as a basis for the payment of FM services.

Why are telematics providers emphasizing support and more fleet management features to add on top of the basic GPS tracking and HOS recording?

The intense competition among the fleet management solution providers from the ELD mandate has resulted in gradual price erosion in recent years.

The downward price pressure for basic solutions is, however, commonly offset through upselling of more advanced features. Therefore, vendors with multiple offerings beyond ELD have continued to see their market grow. Whereas ELD only offerings have only a small shelf life for these vendors. There will likely be another uptick with ELD coming to Canada, but by and large, the vendors dominating the marketplace like Fleet Complete will continue to see their market share grow.

What are some of the beneficial fleet management features to add to the ELD offering?

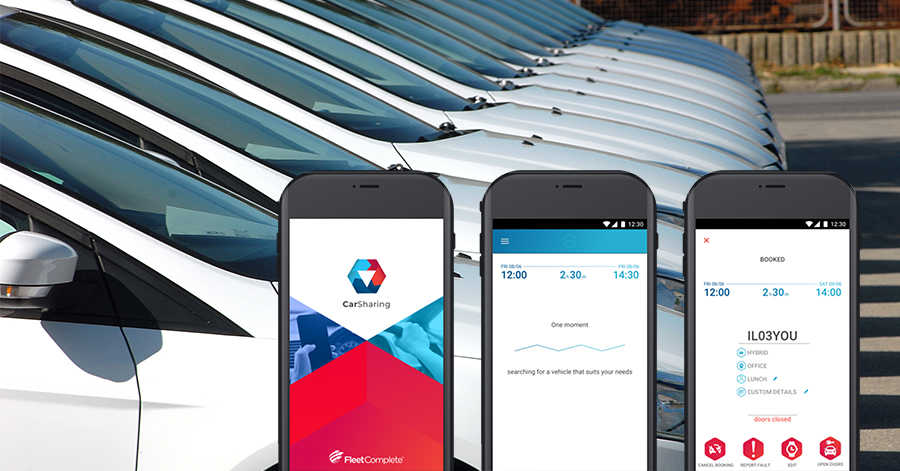

Solutions by Fleet Complete are very versatile and comprehensive. Our approach is – no two businesses are alike, so we offer a comprehensive set of solutions, where clients from any industry can scale with our technology and expand their business opportunities.

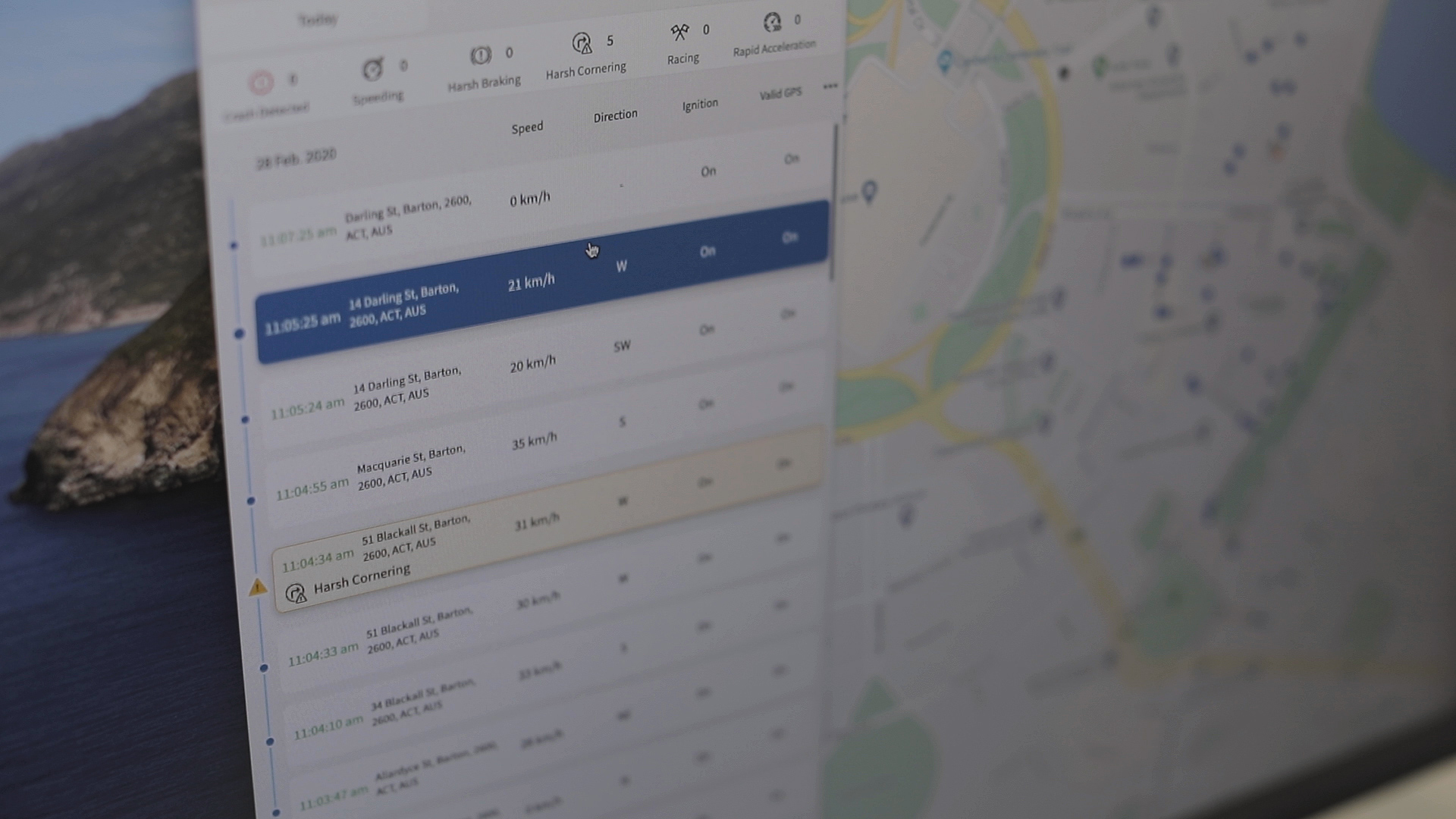

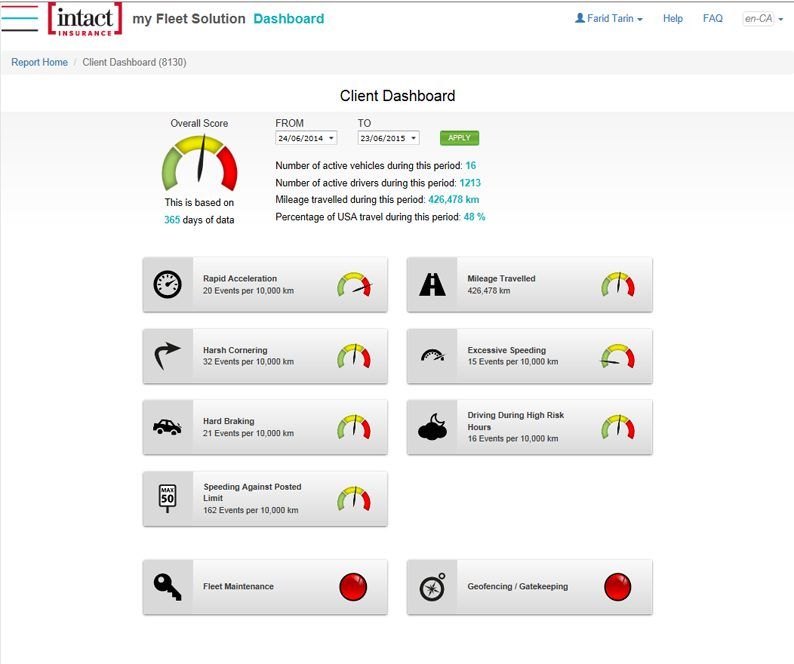

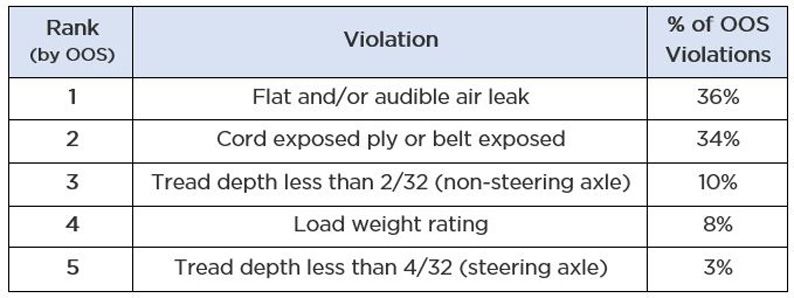

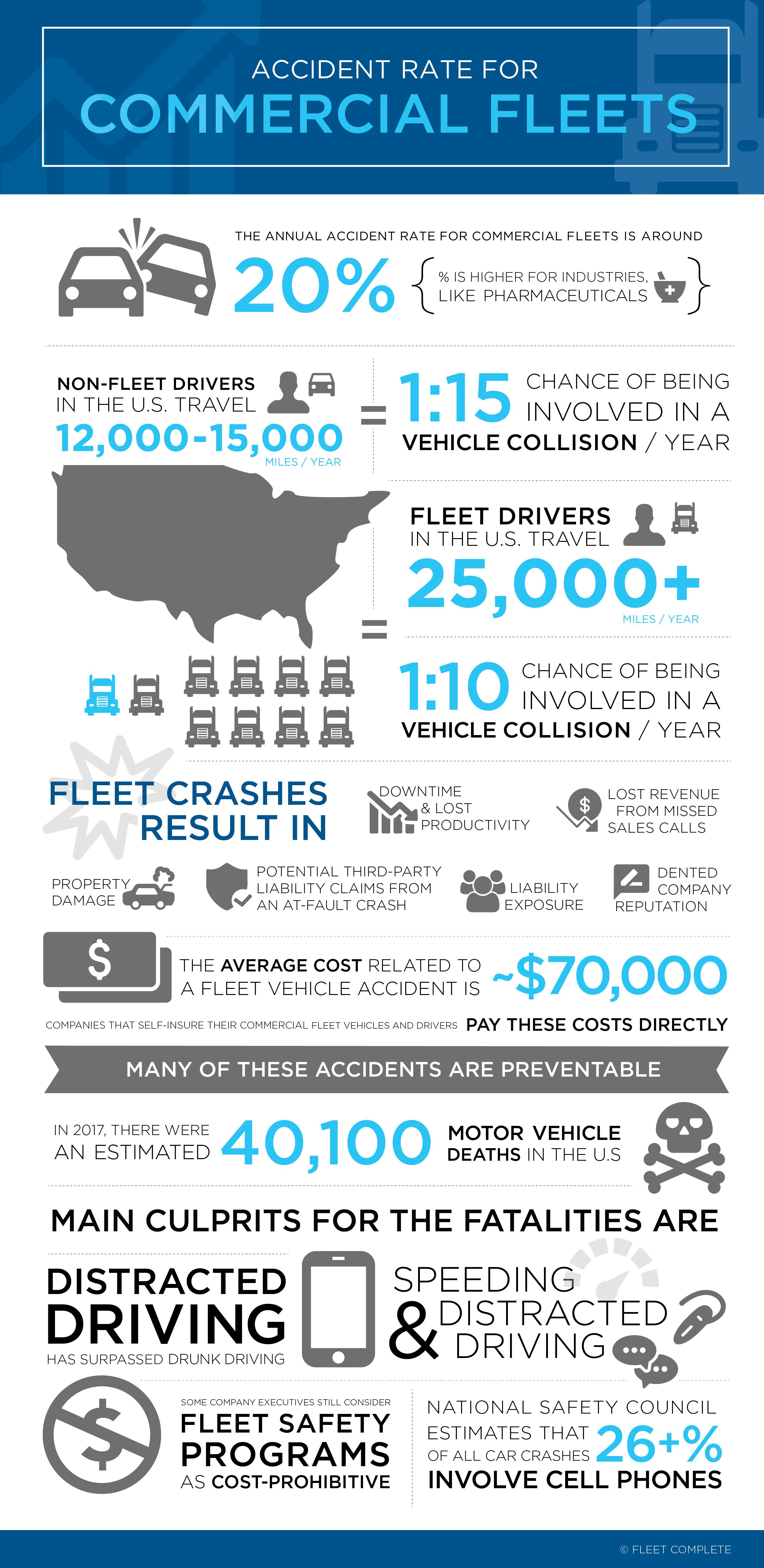

If you are using ELDs for long haul, as a fleet manager or owner-operator, you are also concerned about fuel expenses, proper maintenance, insurance costs and overall road safety. Depending on what your current fleet needs are or what is of highest concern for you at the moment, we offer fleet management solutions that allow you to track fuel economy, maintenance schedules, repairs completed or to be done in an online Mechanic Portal, as well as a variety of sensors like door open/close.

Fleet management technologies are also a great way to manage customer relations and being accountable to your client with proof of action and, conversely, holding your clients accountable. You get reports on where your drivers were at a specific point in time and whether the delivery has been made – if not, you can provide an ETA.

It becomes so much easier to manage client expectations that way. Plus, you can set up a much more precise billing system, as well as budget plans.

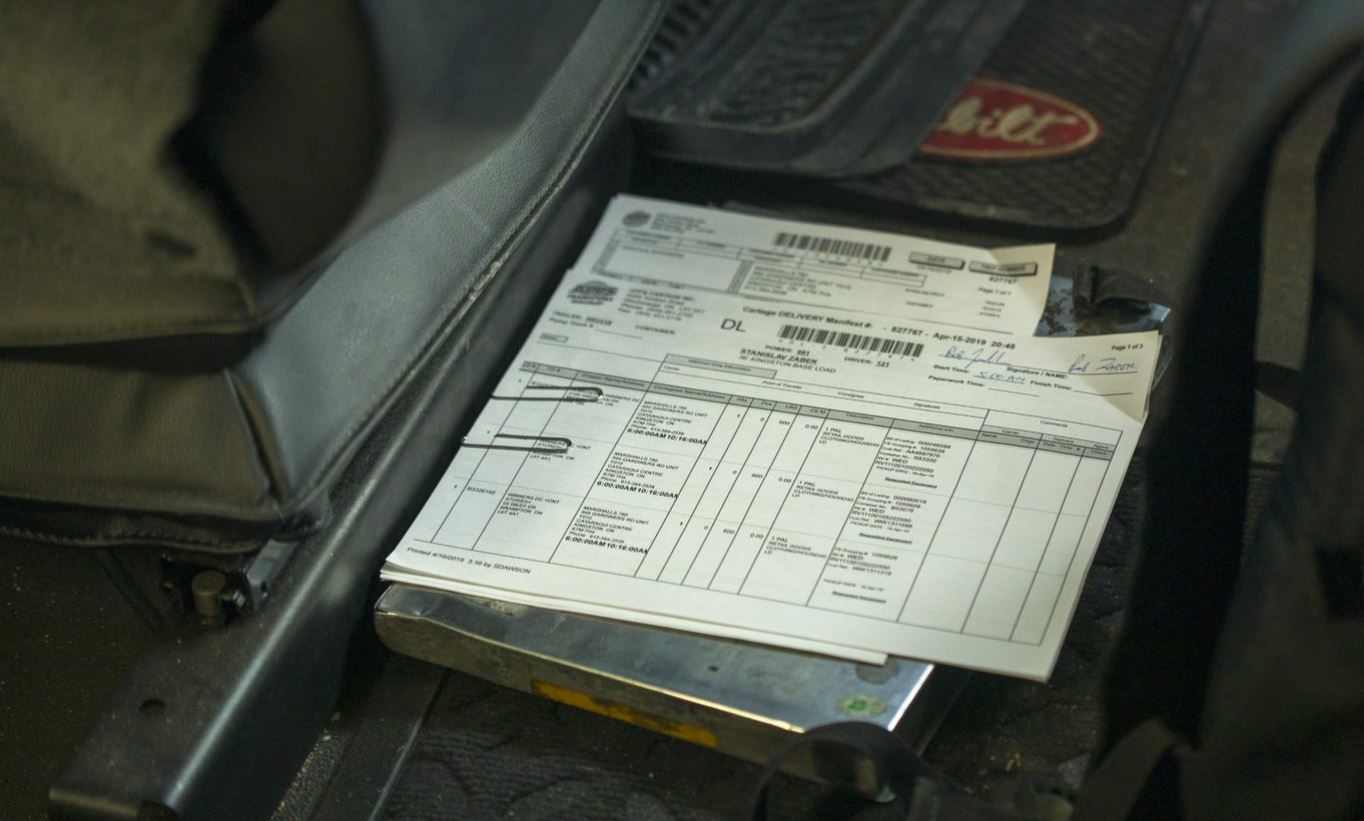

There are other solutions like the Inspect app. This mobile application digitizes your driver vehicle inspection reports (DVIRs), which is very convenient for both fleet administrators and drivers who may need to do it a few times throughout the trip. You can perform an inspection on your mobile phone or tablet, sign off straight in the app, and it will upload the report into the web portal.

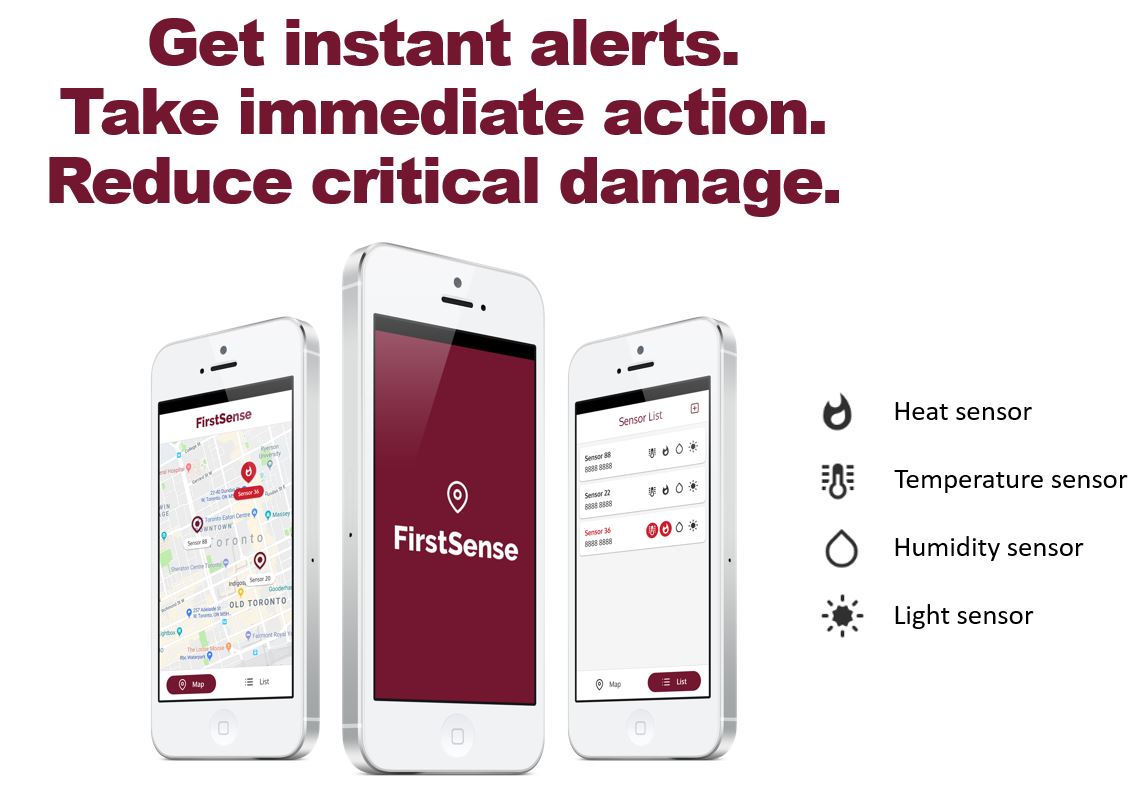

If you are transporting environmentally sensitive cargo, like food or pharmaceutical, we have a dedicated sensor solution that will monitor any temperature variations or air pressure throughout transit.

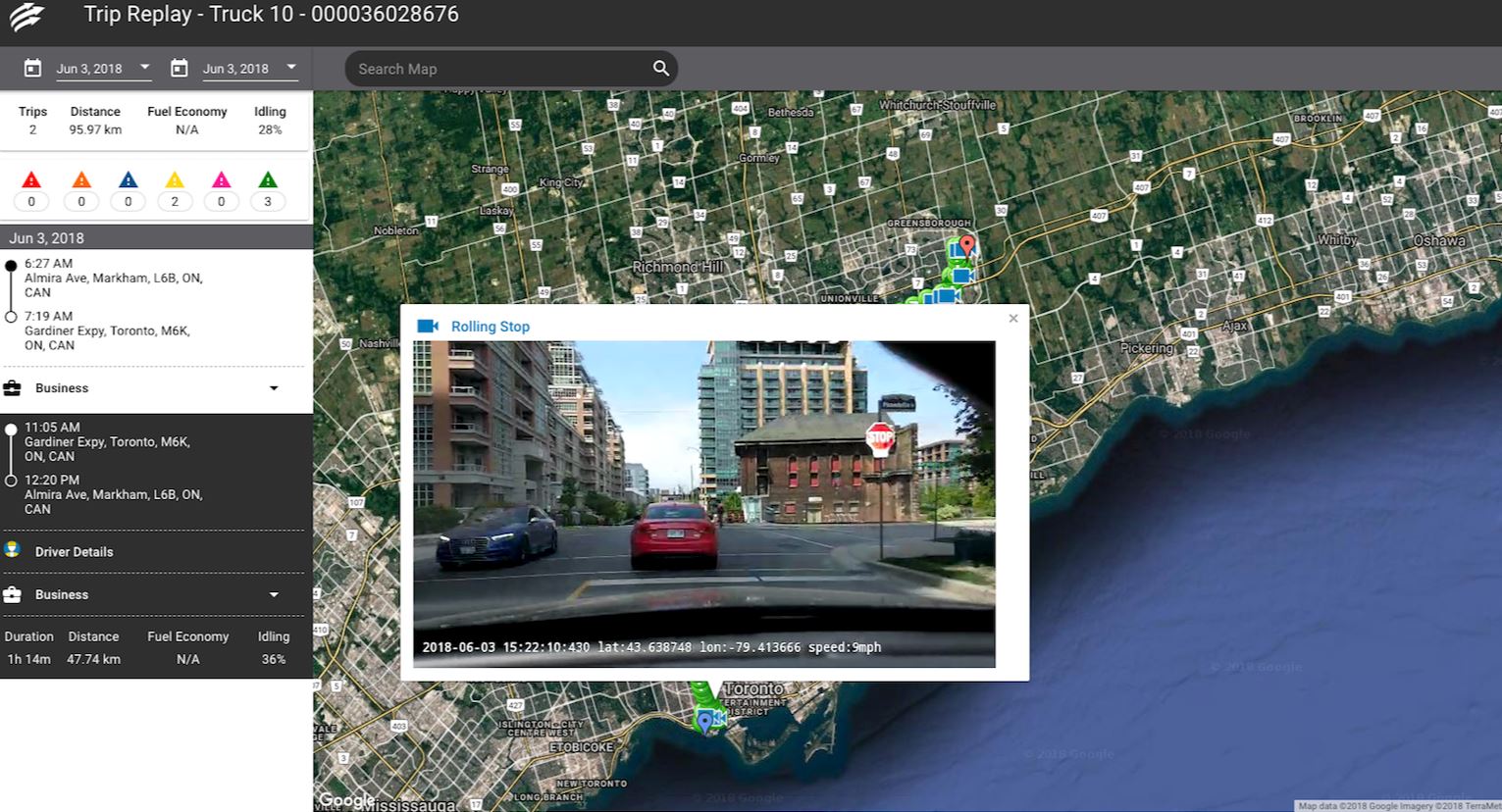

Fleet Complete Vision is another safety value add. The front-facing dash camera and a mobile application not only help keep the drivers alert to traffic violations while on the road, but also potentially protect your drivers from fraudulent at-fault claims.

With the telematics business changing, what is the most significant change that you anticipate?

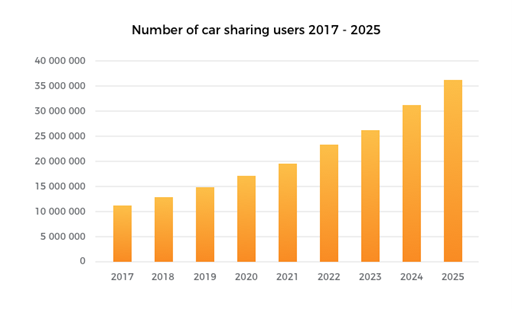

The market for fleet management in North America is in a growth period, which will continue in the years to come. The region fared comparably well during the global financial crisis, and North America was impacted to a lesser extent than many other countries.

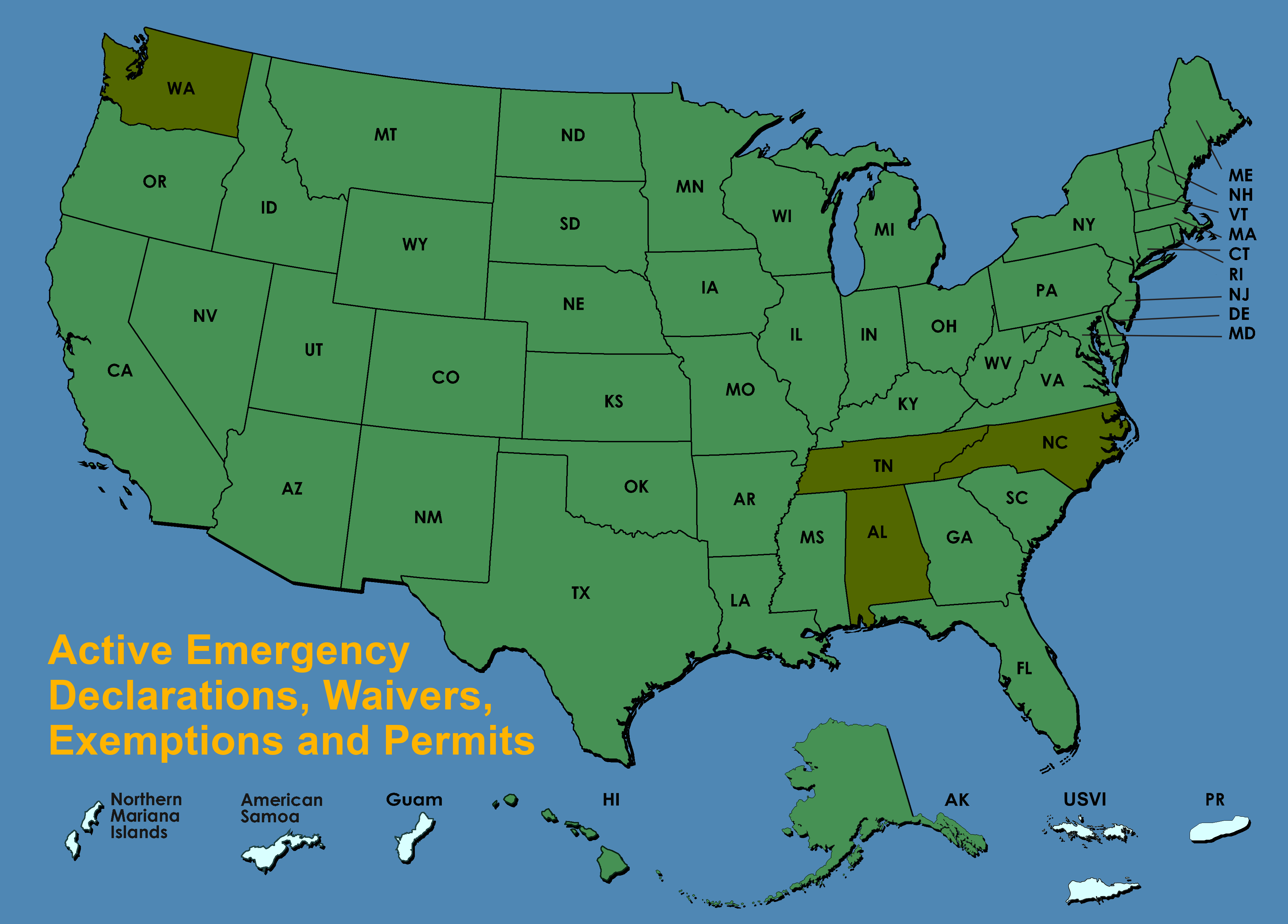

The fleet telematics market in the region is, today, influenced positively by a number of different drivers, including regulatory developments related to ELD, health and safety regulations, the fact that both motor carriers and drivers share responsibility for compliance legislation and road user charges such as IFTA and IRP.

I expect that that the penetration rate for fleet management will continue to increase in North America in 2019–2022. Fleet complete is expanding its presence in Mexico and Greece, along with hiring new staff in that region.