It’s likely no surprise that fleet insurance rates are on the rise. In fact, earlier this year, Insurance Business Magazine reported that US commercial auto rates were up by 7% overall and 7.3% in the transportation sector specifically.

However, what may come as a surprise is that with inflation, risky driving, supply chain shortages and more frequent, severe and larger claims being made, some insurance carriers are choosing to opt out of commercial auto insurance altogether. Those that remain are very selective about the fleet operations they choose to insure.

The good news is that prioritizing safety and risk management and investing in the right technology can improve the chances of being insured and help you secure better rates.

In the article Forecasting Insurance Costs for Fleets and Owner-Operators, Chris Gulker, Practice Leader at TrueNorth Companies, a risk management insurance brokerage notes, “The best way to do this is to invest in safety, compliance and loss control. These are all things that Motor Carriers need to consider in order to best position themselves for favorable renewal outcomes. This can be done by hiring seasoned veterans to support safety, compliance, claims, etc. Fleets can also consider purchasing the latest safety technology – Advanced Driver Assistance Systems (ADAS), collision-mitigation and lane-departure warnings, as well as in-cab video recording systems. Insurance companies will take into account how much a fleet has invested in safety, as they know it will have a direct impact on claims.”

The connection between video telematics and insurance rates

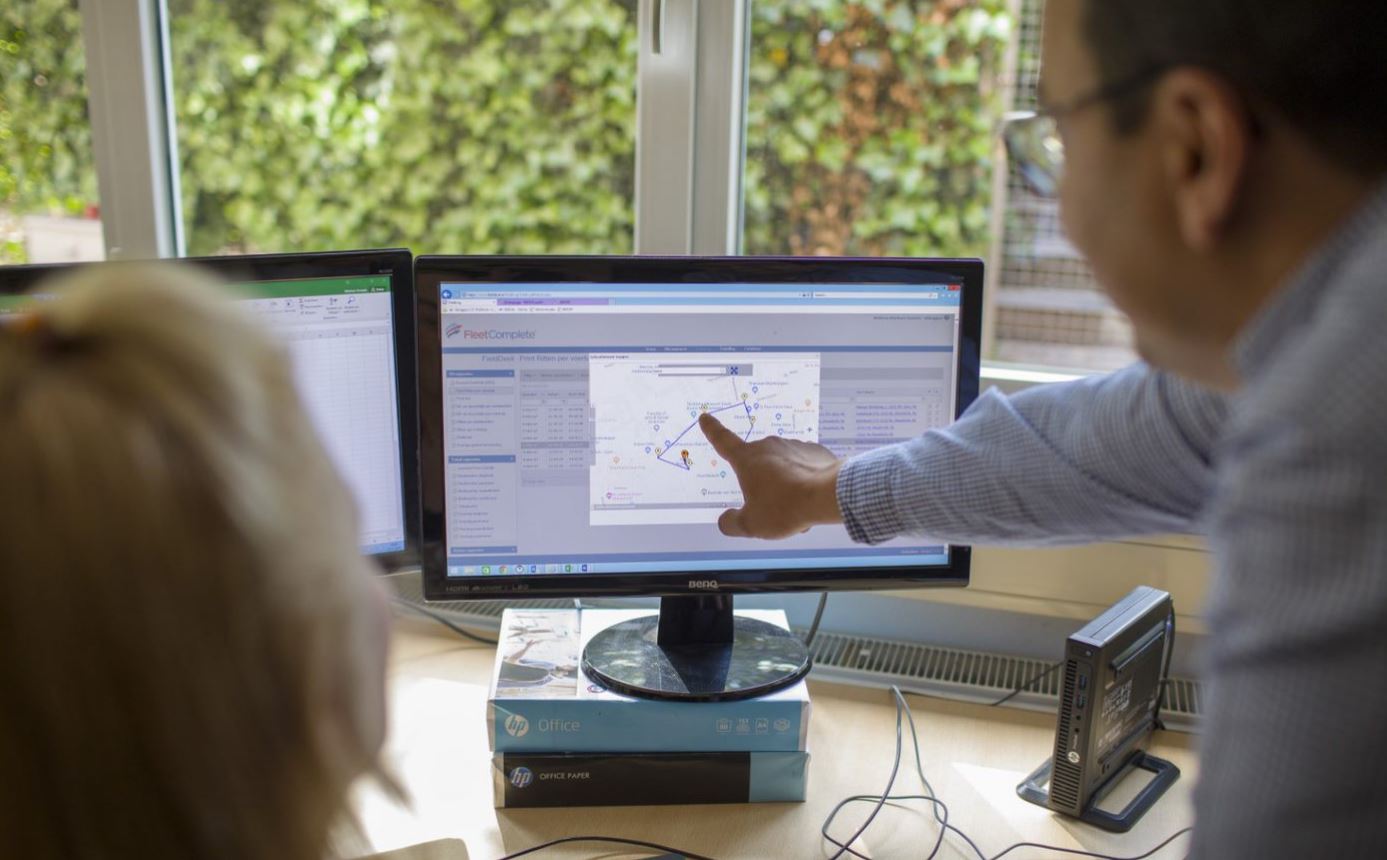

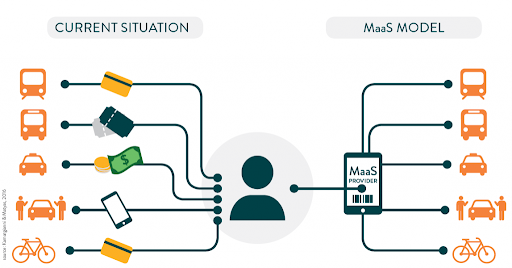

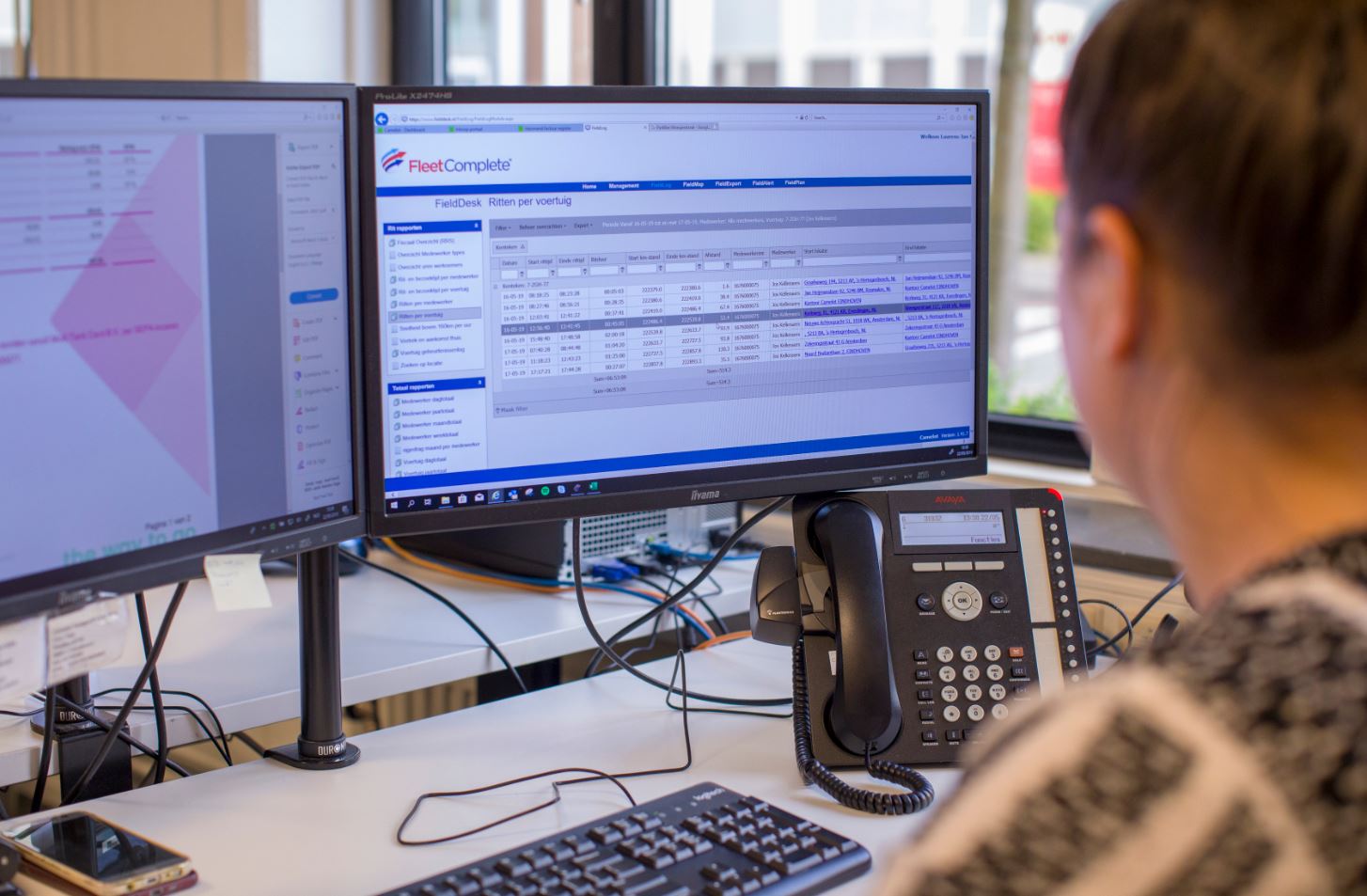

Video telematics technology collects data from GPS, video, and sensors about driver and vehicle performance and road conditions. It feeds this information into a central platform so fleet administrators can monitor people, assets and risk in real-time.

One of the most significant impacts of video telematics on fleet insurance is that it provides more granular data for risk assessment. In the past, insurance rates were based on basic factors, such as the type of vehicle, driver history and location. Now, with telematics, insurers can assess risk on a per-vehicle and per-driver basis, taking factors such as driving behavior, time of operation and mileage into account, allowing them to offer more competitive pricing to businesses with safe and responsible driving practices.

Research shows investing in telematics influences insurance rates

C.J. Driscoll’s & Associates’ Survey of Fleet Operator Interest in MRM Systems and Services examines many aspects of Mobile Resource Management Systems, including GPS fleet management, video-camera-based driver behavior management, interest in these solutions, motivations for deployment and the most important benefits of investing in these solutions.

The 2023-24 edition revealed compelling evidence that investing in video telematics can significantly impact insurance rates. For example:

- 84% of survey participants were very or somewhat satisfied with the decision to invest in video camera systems.

- 64% said that getting lower insurance rates was a primary factor in their decision to invest in this technology.

- More than half (54%) of insured fleets received an insurance discount for equipping their fleets with this solution.

- Just over one third of self-insured fleets reported that their fleet has experienced a notable reduction in losses from accidents as a result of using a GPS fleet management system.

Respondents ranked the following as their top five reasons for investing in video telematics solutions:

- Determining liability (98%)

- Reduce losses from accidents (96%)

- Monitor distracted driving (75%)

- Driver coaching (73%)

- Alert drivers of risky behavior (73%)

The impact of video telematics on insurance and overall fleet management

Determining liability – Drivers are vulnerable to many scams on the road, including being accused of being somewhere they weren’t, causing damage to vehicles they never encountered, or being the cause of an accident when they weren’t at fault. Data collected through telematics solutions can also be used in accident disputes and help insurers more accurately determine liability.

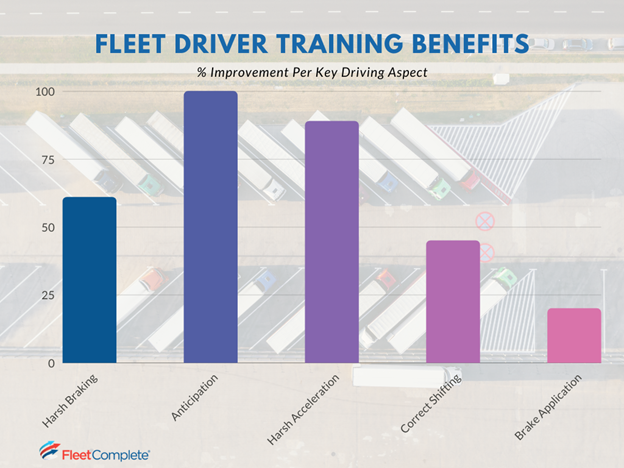

Monitoring distracted driving, driver alerts and coaching – Telematics data helps insurers determine premiums, and provides information that administrators can use to incentivize drivers. When drivers know their behavior is being monitored, they are more likely to adopt safe driving practices, such as obeying speed limits, avoiding harsh acceleration and braking, and taking breaks to meet compliance requirements. And by alerting them to the behavior in the moment, they can correct what they’re doing and contribute meaningfully to risk management.

Reducing losses from theft – Telematics technology can also assist in reducing fraudulent claims and vehicle theft. With real-time tracking capabilities, fleet owners can quickly locate stolen vehicles, leading to faster recovery and reduced losses.

Customized coverage – Instead of applying a blanket approach that doesn’t necessarily reflect the needs and practices of particular fleets, the granular insights and data available with a video telematics solution allow your insurer to customize your packages and rates. For example, a delivery company may want cargo coverage and a construction company may need coverage for off-road usage. The data and insights that a telematics solution provides allows them to create a customized insurance package.

Maintenance and efficiency – On top of satisfying the needs of insurers, the data and insights captured with telematics help you optimize maintenance schedules, reduce the risk of breakdowns, and extend the life of your vehicles. And route optimization helps reduce fuel consumption and improve efficiency.

Brand enhancement – Drivers care that you care. Investing in safety and talking about the importance of safe driving from the start is an important way to show prospective and current employees that the safety of employees, the public and your vehicles is a priority and can set you apart as an employer. Video Telematics Could Help You Attract and Keep Skilled Drivers. Interestingly, the Driscoll research also revealed that over 75% of respondents experienced little to no resistance from drivers.

Environmental impact – By analyzing fuel consumption data and optimizing routes, you can reduce emissions and demonstrate your commitment to sustainability. Some insurers acknowledge these efforts by offering discounts and other incentives.

Show your insurer that you’re serious about safety and risk management with FC Vision

FC Vision is a dash camera safety solution that delivers all of the powerful insights you need to secure competitive insurance rates and optimize fleet management.

- Immediately improve driver safety

- Build driver skill sets and reinforce safety best practices

- Simply and quickly pinpoint the time and location of an event

- Avoid costly false claims

- Easily integrate with fleet management software

- Increase employee retention

FC Vision includes:

A dual-facing camera that provides a crisp, clear image, live video streaming, and desktop, email, and text alerts for managers. And, for optimum benefit, you can combine your video telematics solution with a safety leader board to:

- Provide drivers with the tools to monitor and correct unsafe driving habits on their mobile devices.

- Recognize top drivers and motivate others.

- Pinpoint the safest and least safe drivers within a specific timeframe.

- Identify the most common unsafe behaviors that could increase insurance rates while putting people and your operation at risk.

- Monitor the number of dangerous driving events that occur per 100 miles for each driver.

Newly launched FC Vision features are sure to make your fleet more attractive to insurers

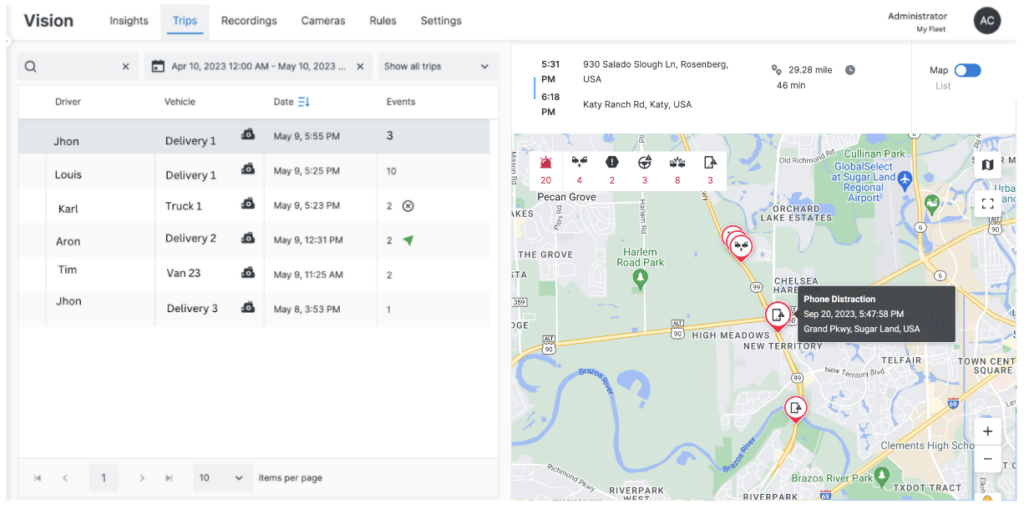

Phone Distraction Reporting

Fleets using dual-facing cameras can take advantage of Phone Distraction event reporting. This high-risk driving behavior is on the rise and the amount of time drivers, dependent on phones for information, spend on their devices for every hour of driving continues to grow.

With FC Vision’s Phone Distraction feature, an event is triggered when the driver holds a phone up to their ear for a minimum of 4 seconds. An in-cab audio alert helps drivers correct this behavior on the spot and focus on the road. The event is reported and displayed on the FC Vision module so Fleet Administrators can coach drivers on this behavior.

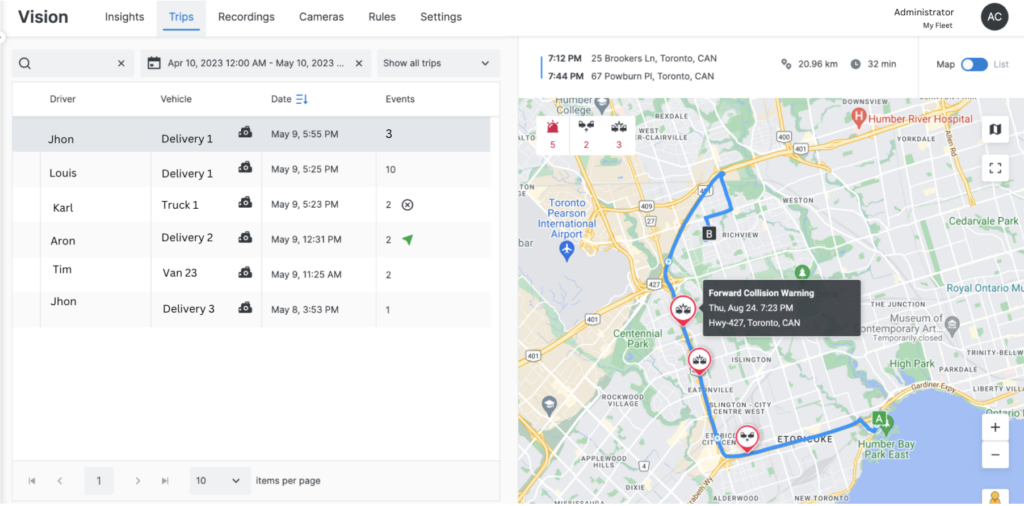

Forward Collision Warning

This feature is triggered when drivers get too close and are in danger of rear-ending vehicles in front of them. An in-cab audio alert announces the risk to the driver so they can correct the behavior on the spot. Once again, administrators can see that a Forward Collision Warning has been triggered in real time on the FC Vision module so you can monitor and coach in the moment.

As technology advances, the connection between insurance and video telematics will only grow stronger. By embracing the power of video telematics, you are not only giving your business a competitive edge, you are taking proactive steps to reduce insurance costs, enhance efficiency and make the roads safer for everyone.

To learn more about how video telematics can help you keep insurance costs under control, contact our experts