The big toilet paper panic-buy may have subsided—but due to COVID-19, consumer demands are changing—and this will have a knock-on effect on fleets. 2020 has reshaped the way carriers operate, from the way managers train staff to the logistics industry as a whole.

In this article, we discuss where the biggest impact was felt, and what it means for the future as we adapt to the ‘new normal’.

1. Adapt to Succeed

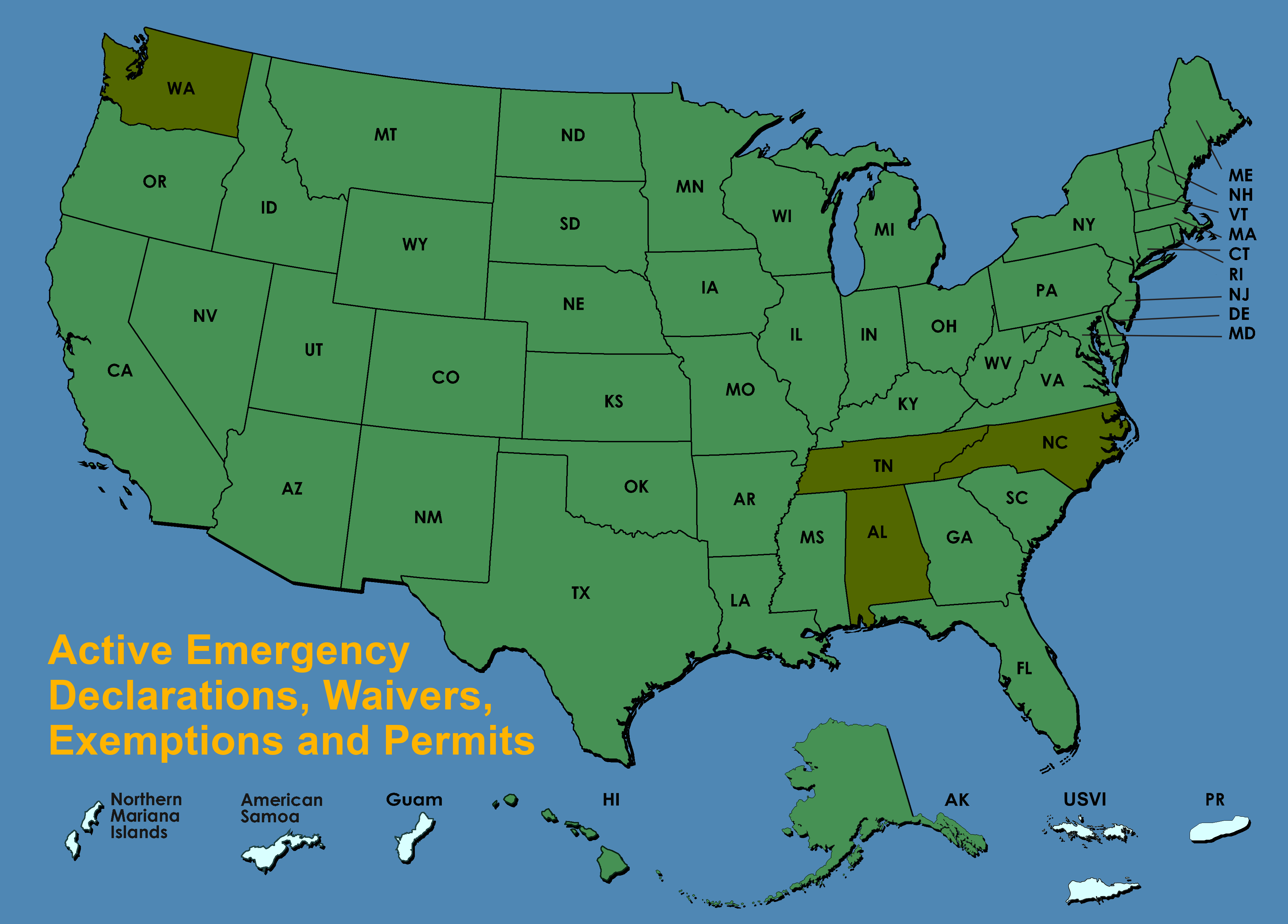

Some sectors have seen a dip in demand, while others have had to work around the clock to fulfill orders. And fleet managers needed to either adapt quickly to these fluctuating demands or slip into complete chaos.

Additional demand for certain services—especially food and medical supplies—has put a strain on commercial trucking. Meanwhile, reduced employee availability, due to lockdown restrictions, means a shortage of staff.

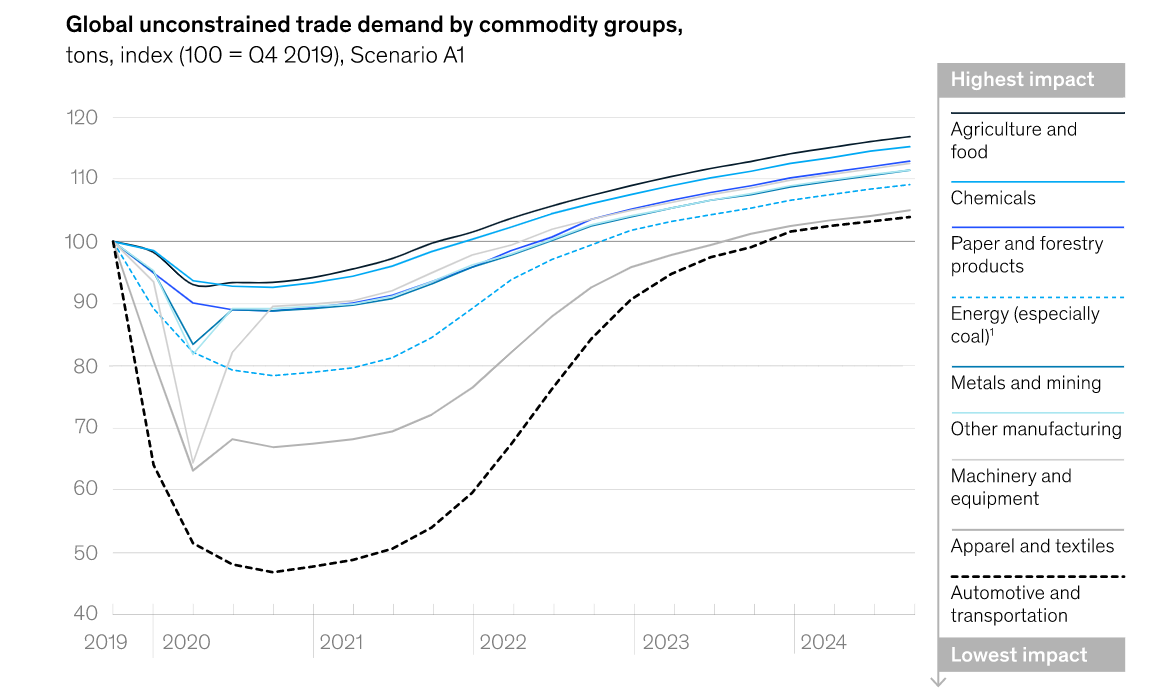

Now that most carriers have managed many of the pandemic’s immediate challenges, they need to re-evaluate what the new business landscape will look like for their businesses. Keeping a close eye on commodity data can help guide managers through the crisis.

McKinsey recommends a three-stage approach:

- Scenario development. Carriers can better understand which scenarios they need to plan for with a detailed understanding of the factors that affect overall supply and demand.

- Commercial strategy. Data can provide an early indication of developing scenarios, helping managers identify opportunities around sales-force focus, commercial offerings, and pricing strategies.

- Operational strategy. Bottom-up supply-and-demand modeling can help managers confidently adjust capacity and expenditure as the road to recovery becomes clearer.

2. Change Your Safety Policy

Social distancing rules have changed the way training is carried out. With only one person allowed in a cabin at any time, fleet managers have adapted to using screens and voice instructions.

Meanwhile, the day-to-day running of businesses is putting more focus on employee health and safety. According to a recent Automotive Fleet Survey, 80% of respondents are taking actions to protect the health of employees during the pandemic, with 89% providing masks, 88% providing hand sanitizer, 87% providing cleaning solutions, 84% enforcing social distancing practices, and 81% providing gloves.

Other policy changes include no-contact deliveries, more rigorous disinfecting steps including daily cabin cleanings, and business meetings conducted over the phone or internet.

3. Curbside Drop-off Is Here To Stay

Due to social distancing, many drivers are opting to drop off deliveries at the curb instead of entering homes and offices and possibly exposing themselves to the virus. Even as we emerge from the pandemic, it looks like curbside delivery is here to stay.

But, as with all things, there are hurdles and opportunities.

“This is undoubtedly one of the trends that will stick post-virus. It is a win-win for consumers and retailers. From the shopper point of view, it is convenient and quick; from the retailer point of view, it is more cost-effective than delivering to home,” Neil Saunders, Managing Director, GlobalData told RetailWire.

He added:

“There is a hurdle of managing the volume at peak times, something even Target sometimes struggles with. You also need to have a suitable area for pickup to happen – preferably not right in front of the store entrance where customers are going in and out. Walmart has created separate areas for pickup which works well.”

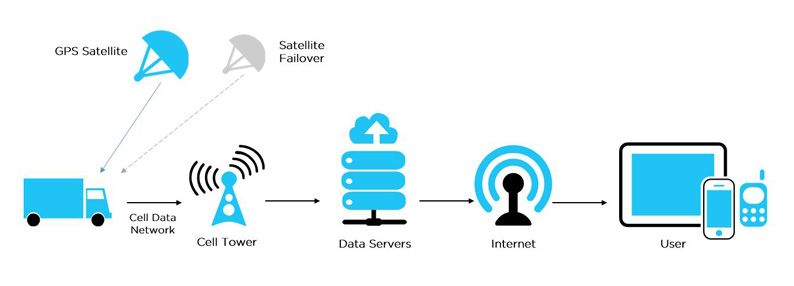

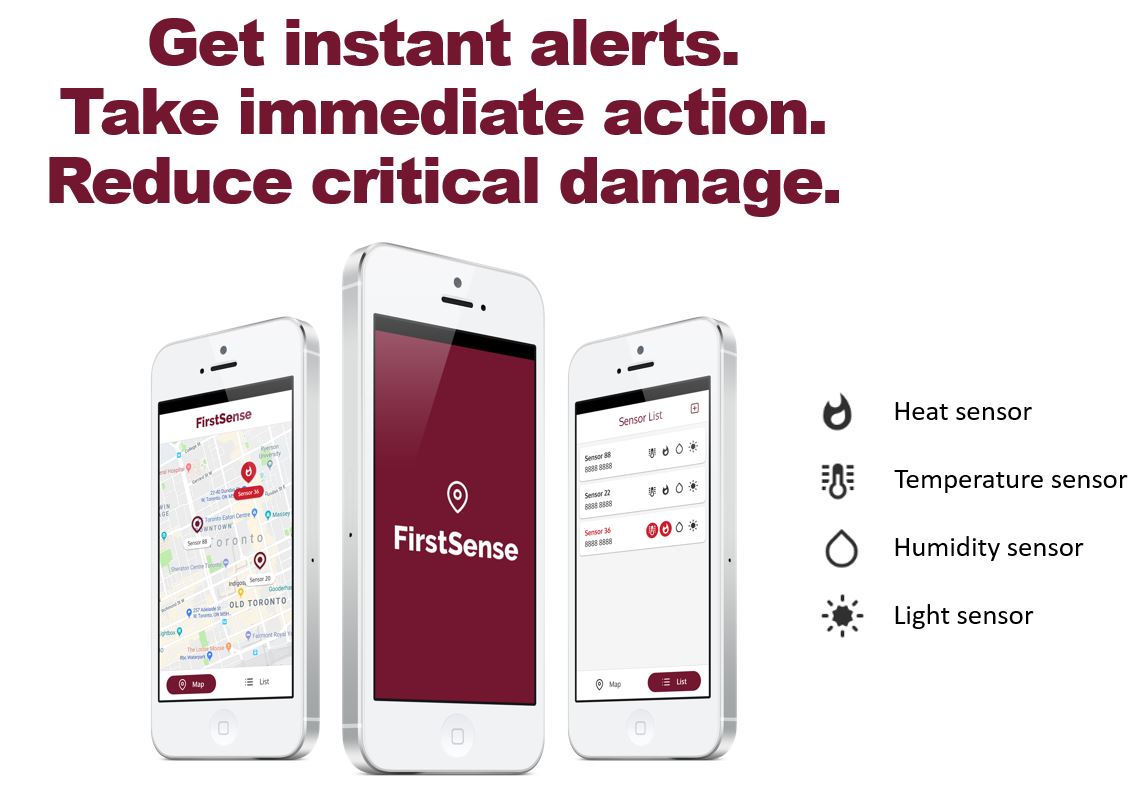

The demand for contactless fulfillment is spurring carriers to pursue new pickup options, and GPS fleet tracking software has never been more useful for drivers who have needed to change their routines.

4. Change the Way You Operate

The full effect of the health crisis on global supply chains is still unknown. An expected recession will affect demand for trade, manufacturing, and goods—which will, of course, impact logistics companies.

“I think the reality for fleet operators is that they’re likely to see impacts well into 2021,’ says Paul Hollick, chairman of the Association of Fleet Professionals (AFP). “The other big thing, of course, is cost-saving and cost-reduction as everybody starts to tighten their belts.”

Not all sectors will be affected in the same way, however, Hollick notes:

“The van market has just gone crazy because of course, the delivery sector in a COVID-19 world requires a lot more vans on the road to be able to lift goods and services to people’s address rather than to deliver to depots.”

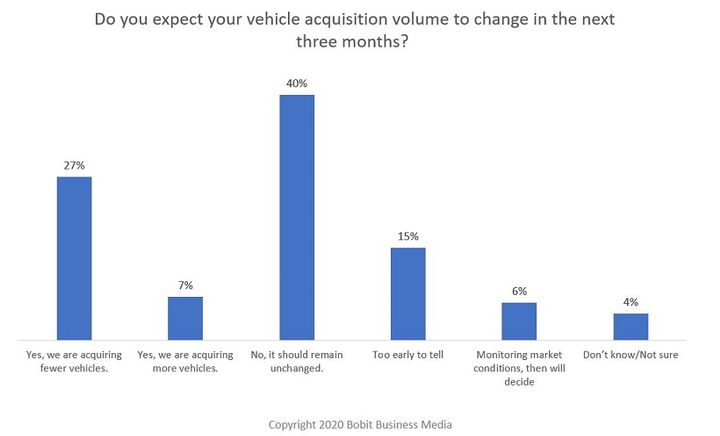

The rise in parcel deliveries means some carriers might decide to add more light commercial vehicles (LCVs) to their fleet. Others might buy or rent bigger LCVs to cope with more orders. At the same time, many fleet operators are putting off investing in new vehicles until they feel more confident about business over the next couple of years.

The majority of respondents said vehicle acquisition volumes would remain unchanged over the next three months (Image Source).

5. Technology to Manage Costs

COVID-19 has created a seismic shift in the way fleets are run. The pandemic’s impact has changed how vehicles are managed, operated, and sourced, and will continue to change the industry long after we emerge from the crisis.

Although the pandemic will likely change the overall industry picture, the relative increasing business volume for small and micro fleets means they’re now facing bigger challenges usually encountered by mid-size and large fleets—increasing business costs, regulation compliance, and competitor pricing.

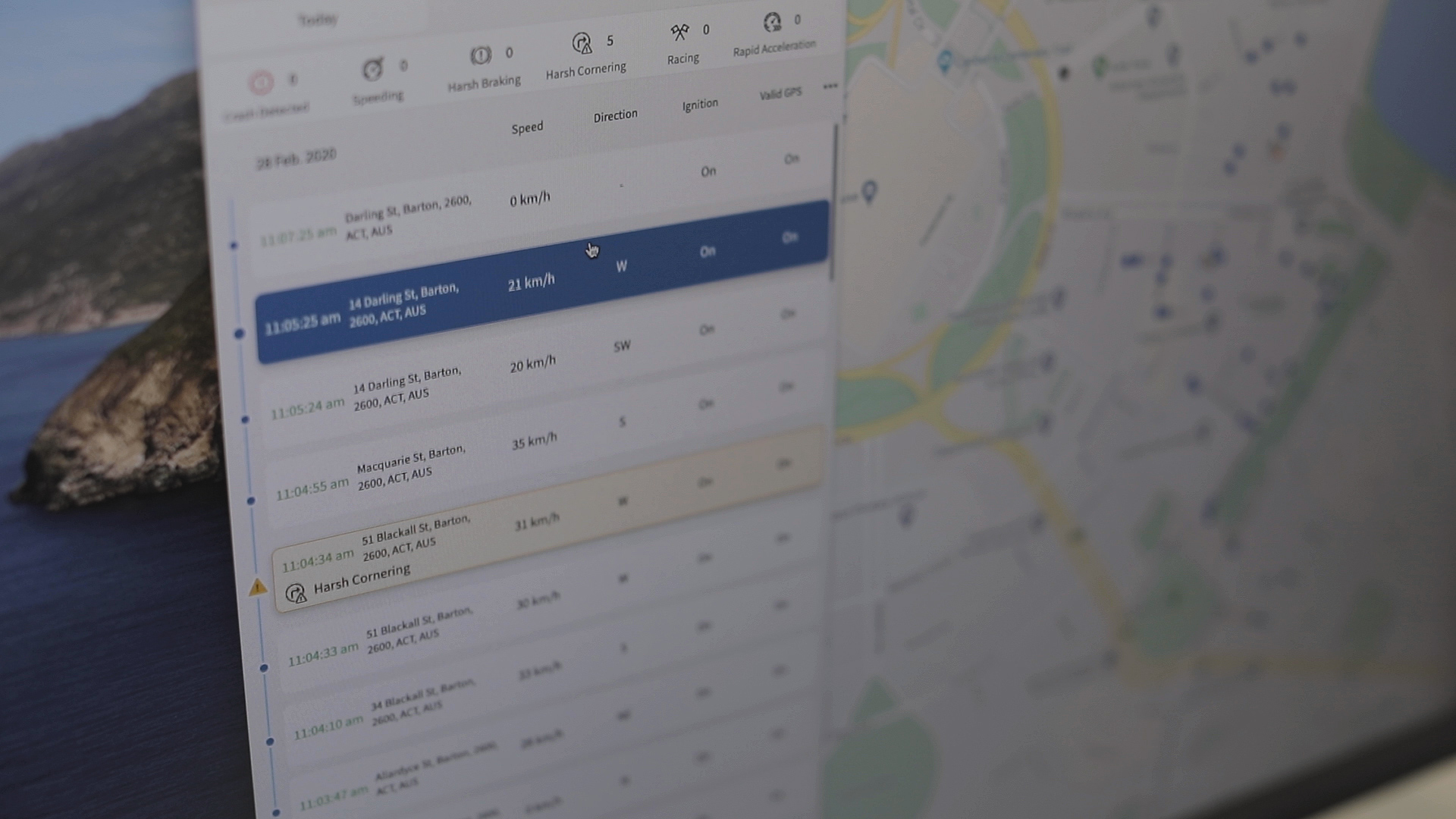

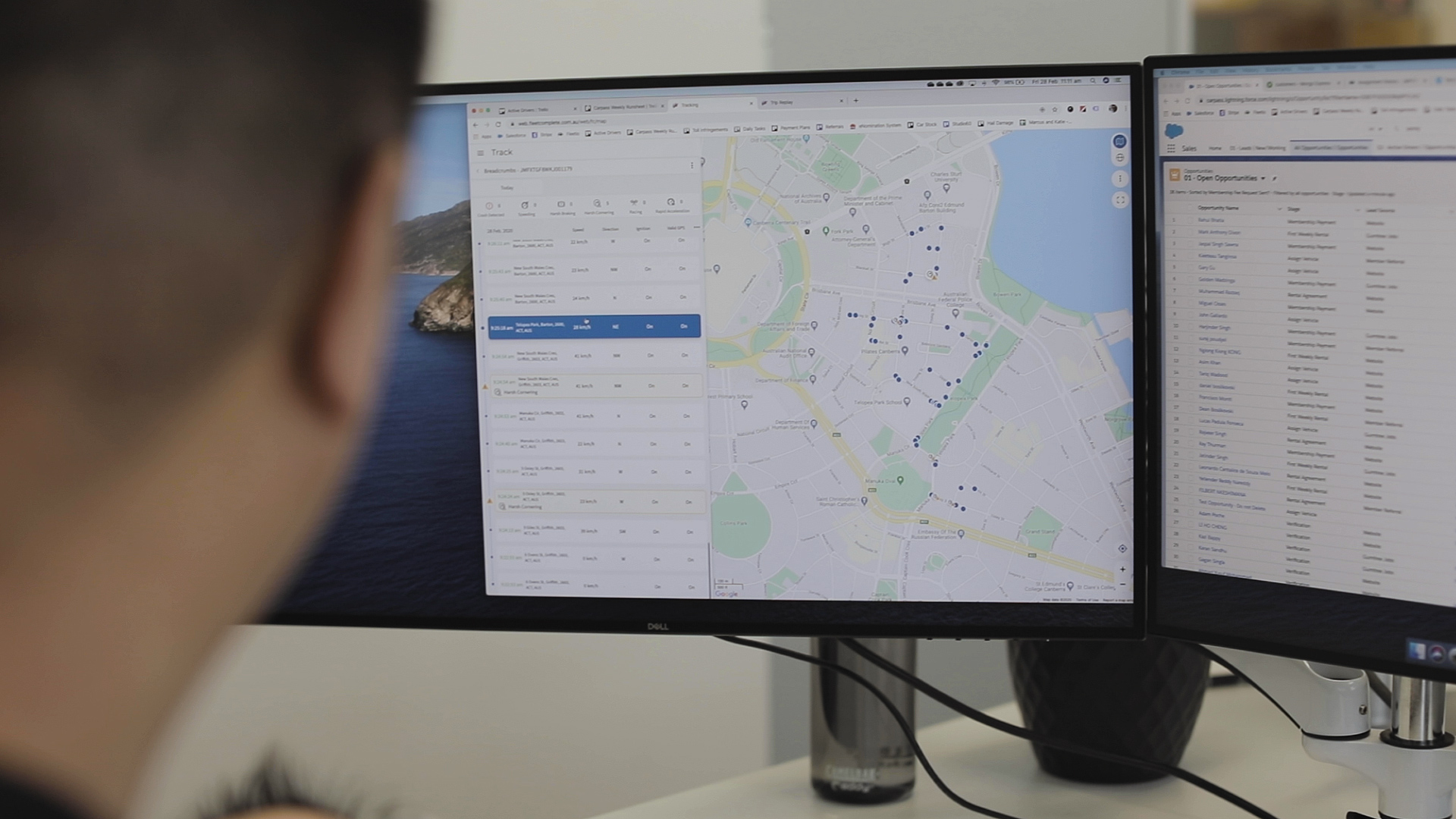

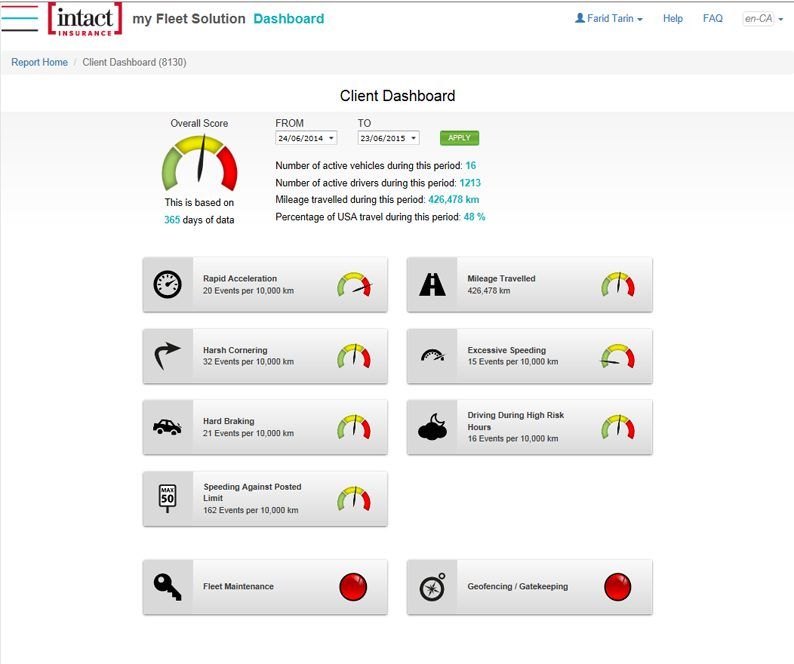

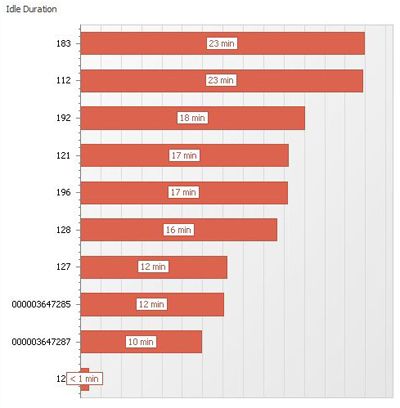

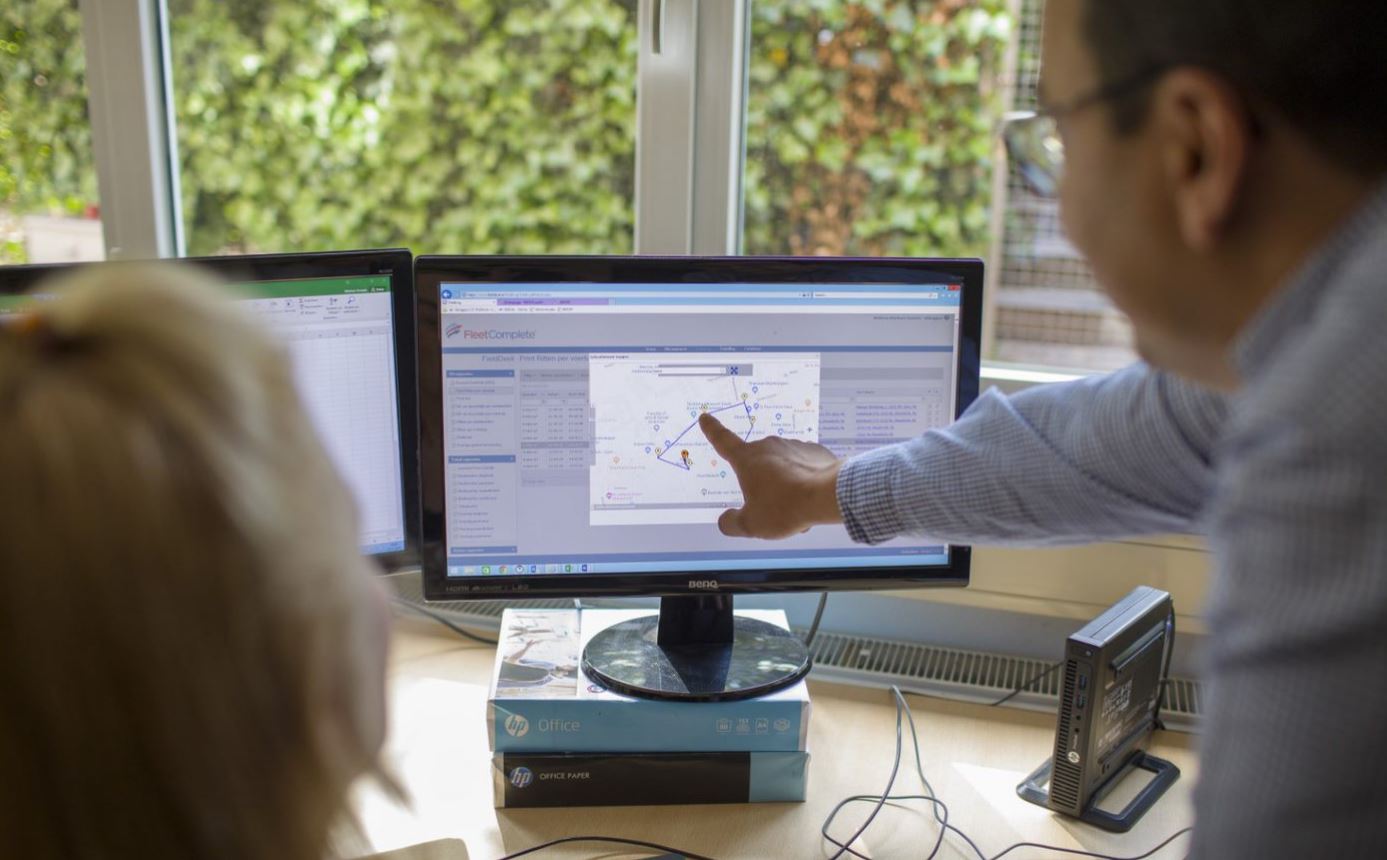

It comes as no surprise that the top reason fleets invest in telematics technologies is to reduce costs and ensure the new safety standards are met—because telematics software allows for remote visibility.

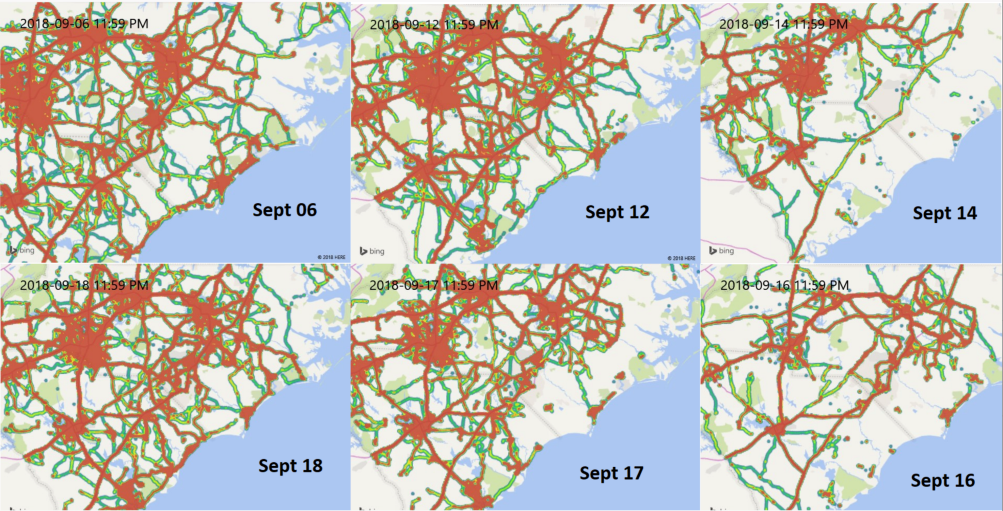

With telematics, you can plan routes, pick the fastest times, monitor driver progress, and send updates to the customer—all in real-time. Route planning is about more than just getting things from point A to point B: it’s being more proactive than reactive, and being ready to adapt to challenges in real-time.

If you’d like to learn more about how Powerfleet (formerly Fleet Complete) can help keep your business ahead of the post-pandemic curve, request our Powerfleet (formerly Fleet Complete) demo. Don’t hesitate to contact us if you have questions about how telematics can save your business money.