The average fleet wastes between 5% and 10% of its annual budget.

That’s money you’re losing instead of using to pay out those tasty End-of-Year bonuses.

So, how can you put that money into your business instead of spewing it out the tailpipes of your fleet?

This guide presents 5 time-tested, manager-approved techniques to make yourself future-proof and darn-near irreplaceable.

1. Preventive Maintenance vs. Corrective Maintenance

We don’t need to convince you that it’s cheaper to prevent a repair than to pay for one. You already know that. Vehicle breakdowns cost a lot of money.

However, you may be unaware that it costs about four times more to repair a vehicle on the side of the road than in the shop. And vehicle repair costs are not merely paid in money; unanticipated repairs also cost you lost time.

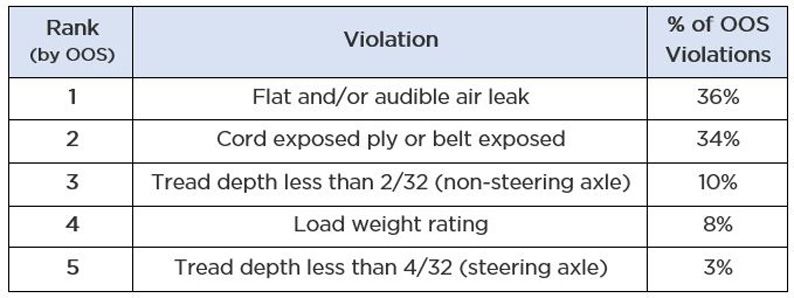

Preventive maintenance is the most effective way to prevent those costly roadside breakdowns. Regular vehicle maintenance checks can help you slash those expenses caused by breakdowns.

Yet, some shops still prefer to use corrective maintenance.

“What’s that,” you ask?

“Corrective maintenance” is reactive rather than proactive. It’s what you do when a vehicle is brought into the shop to repair something that’s broken. You wait until something fails before you try to fix it.

The inevitable result of this type of “maintenance” is unanticipated downtime.

On the other hand, preventive maintenance is planned. You know when each vehicle is due for maintenance; therefore, you can plan around it.

Yes, regular preventative maintenance requires you to invest time and money you’d rather not spend. However, that investment will pay off many times over from one budget to another.

Preventive maintenance is an attitude. It means you are constantly on the lookout for things that might go wrong. Reduce the nasty surprises and costly breakdowns, and you’ll see more money flowing to your bottom line.

That’s a worthwhile investment.

2. Buy Vehicles with Lower Depreciation

As vehicles age and wear out, their value decreases. Many fleet managers assume that the value of their vehicles at the end of their useful life will be zero.

However, that’s not necessarily true.

When buying new vehicles, take the depreciation rates into consideration. Vehicles with more residual value once it’s time to retire them from the fleet will drive more money to the bottom line.

Start with a vehicle that maintains its value. Use a depreciation calculator to select your vehicles. Then, be diligent to perform regular preventative maintenance.

With this simple approach, you could recoup as much as 20% of the purchase price of your vehicles after five to six years in service. Play your cards right, and – even after 10 years of service – you could still recoup as much as 10% of the purchase price of your vehicles.

3. Plan Fuel-Efficient Routes

Fuel costs are one of the biggest expenses in any fleet’s operating budget. A recent survey of fleet managers revealed a shocking reality: 53% of the time, fleets exceed their fuel budgets.

Ouch.

Why does this happen? And how can you avoid such a fate?

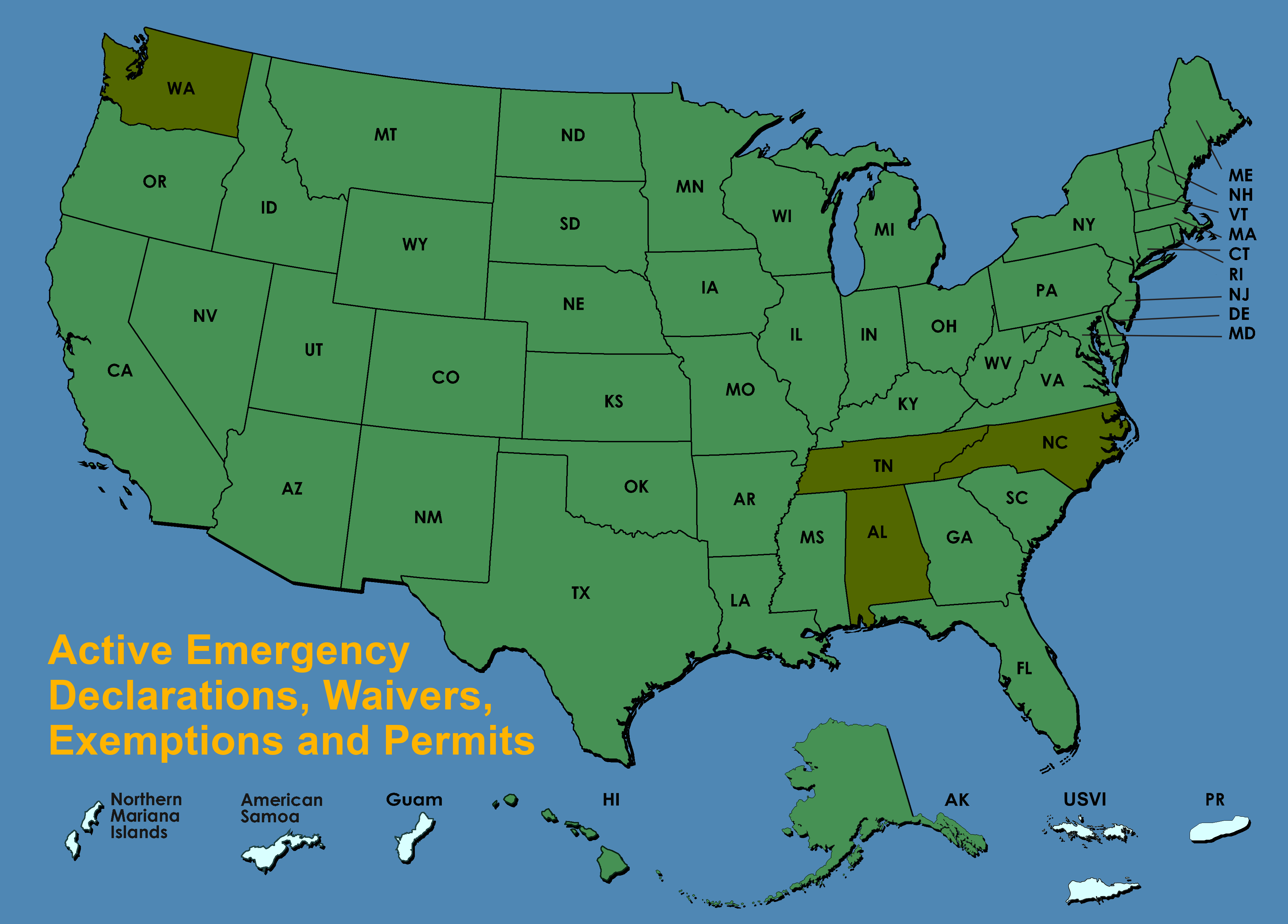

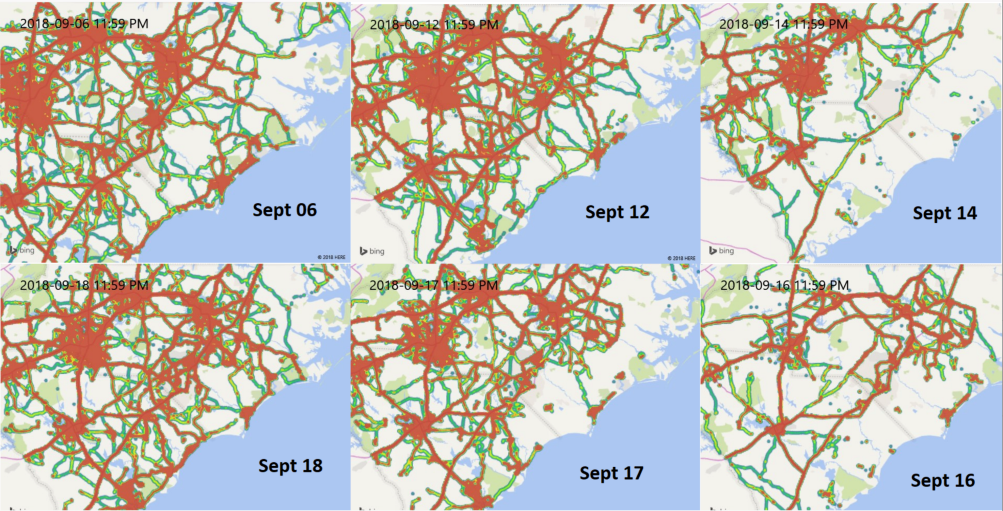

The chief causes of unbudgeted fuel consumption are unforeseen traffic congestion and inefficient route planning.

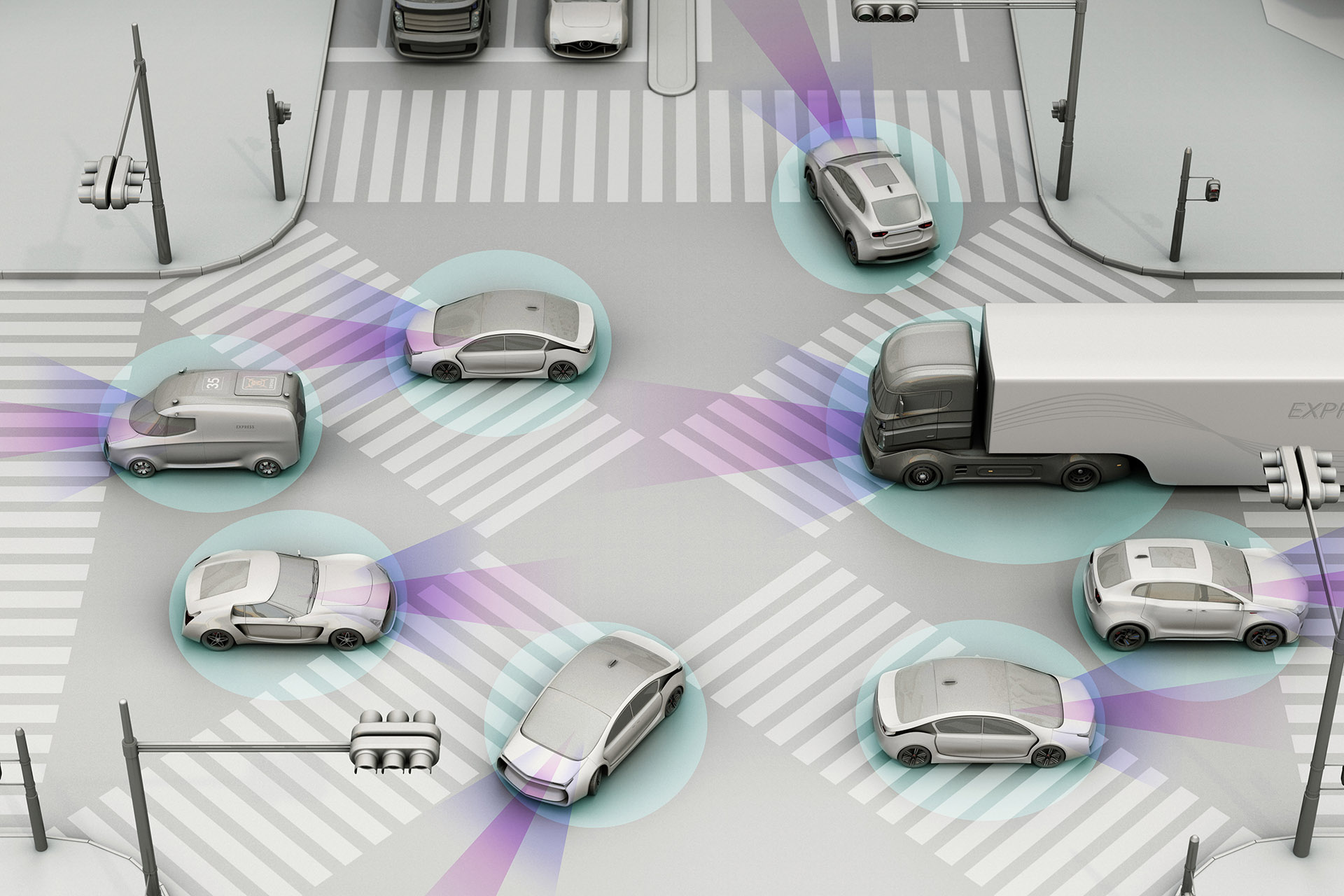

You can reduce or even eliminate these causes with an automated route planner. Efficient route planning considers all these constraints when planning a route.

- Traffic

- One-ways

- Left-turns

- Sunrise / sunset

- Height / load / weight / cubic volume

- time-of-day

If you plan your routes manually, you’re wasting massive amounts of time. (Time you know you don’t have.) There are just too many variables to consider for a human to do it faster, (or better), than a computer.

And there’s zero chance your routes are as efficient as they could be.

Worse, you lack the information necessary to improve your routes and drivers: fuel use, miles driven, drive time, stops made, profit.

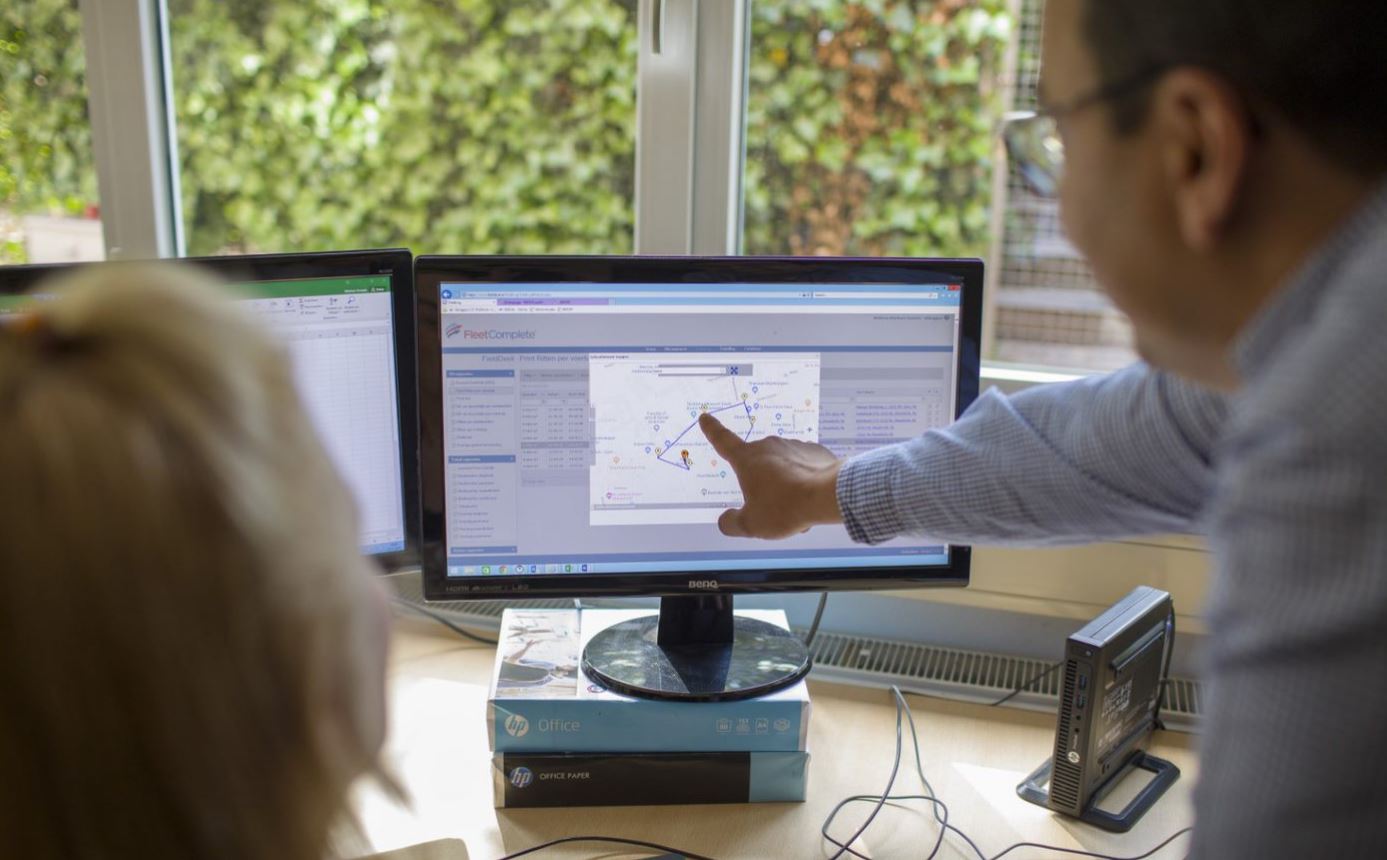

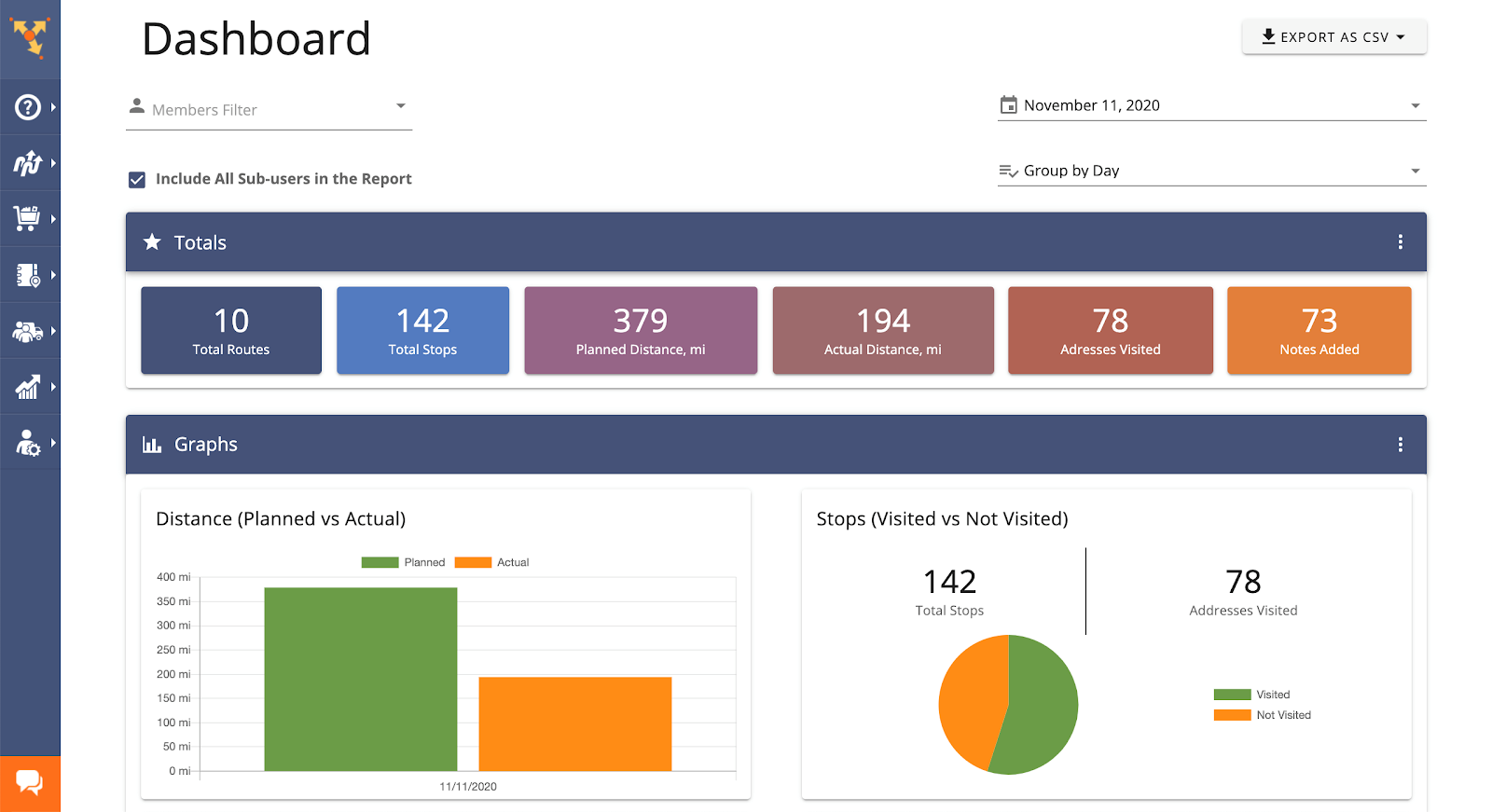

The best route optimization and fleet management software will not only optimize your commercial vehicle routes, it will let you compare Planned vs Actual performance.

With optimized routing, your drivers will have accurate driving directions from one place to another, will avoid predictable traffic jams, and make more on-time deliveries.

Optimized routes let your drivers make more stops in the same time. And that means you can get more done with fewer vehicles and people.

In other words, they will make better use of their drive time and your resources.

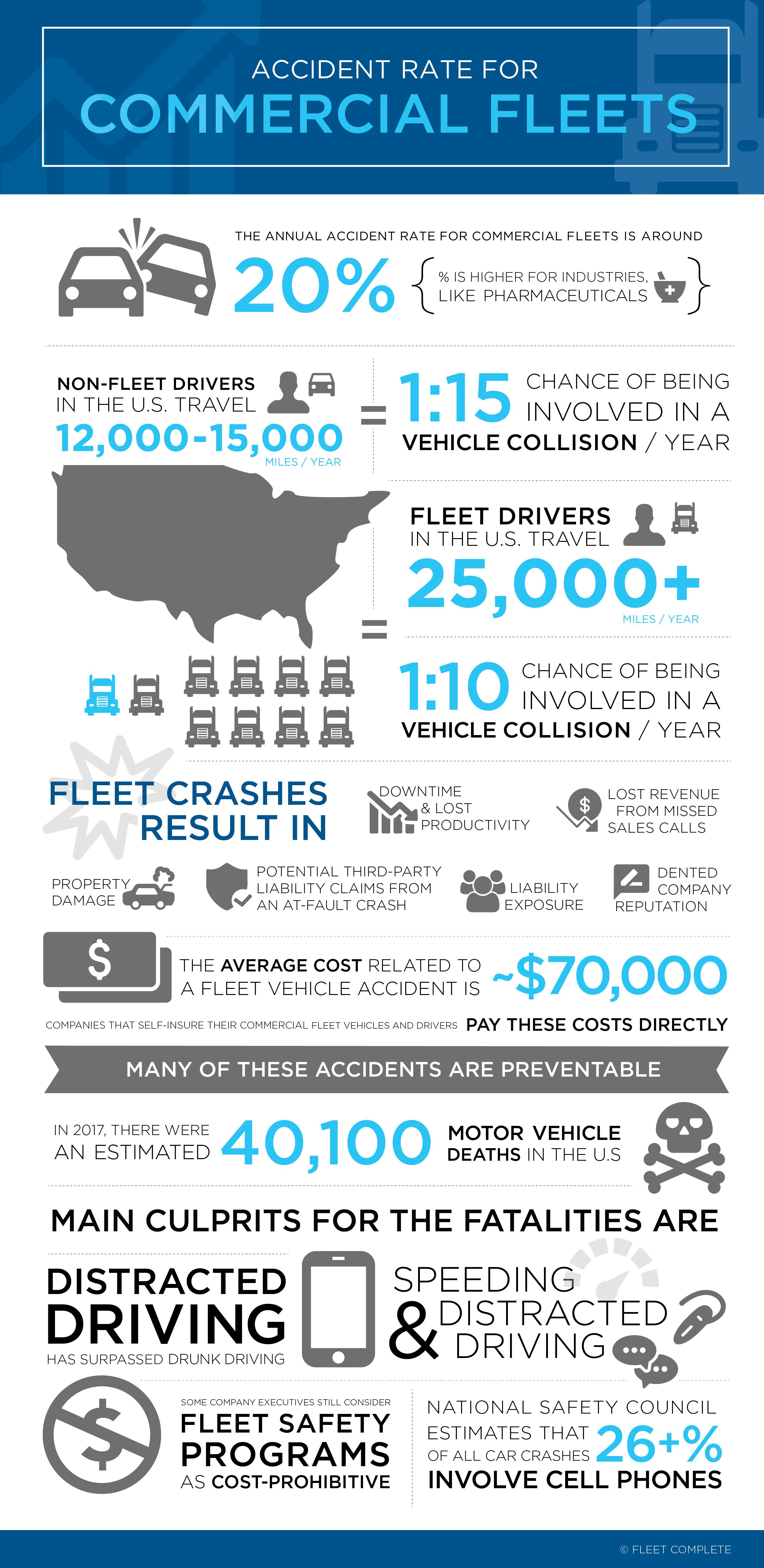

4. Monitor Driver Behavior and Performance

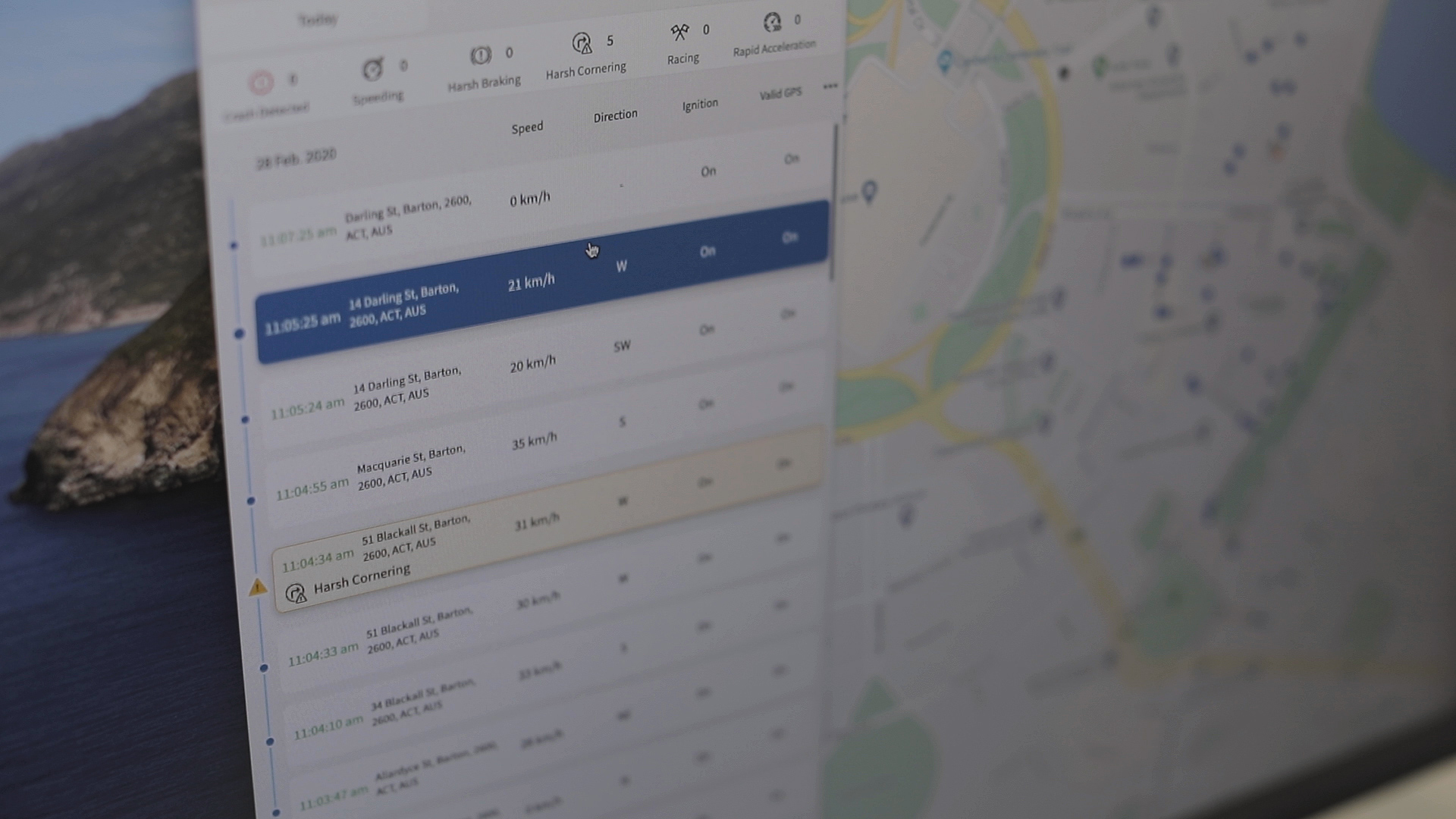

According to a report by the US Department of Energy, a long-haul truck idles about 1,800 hours annually. That translates to 1,500 gallons of diesel consumption. Similarly, speeding can increase fuel consumption as much as 20%.

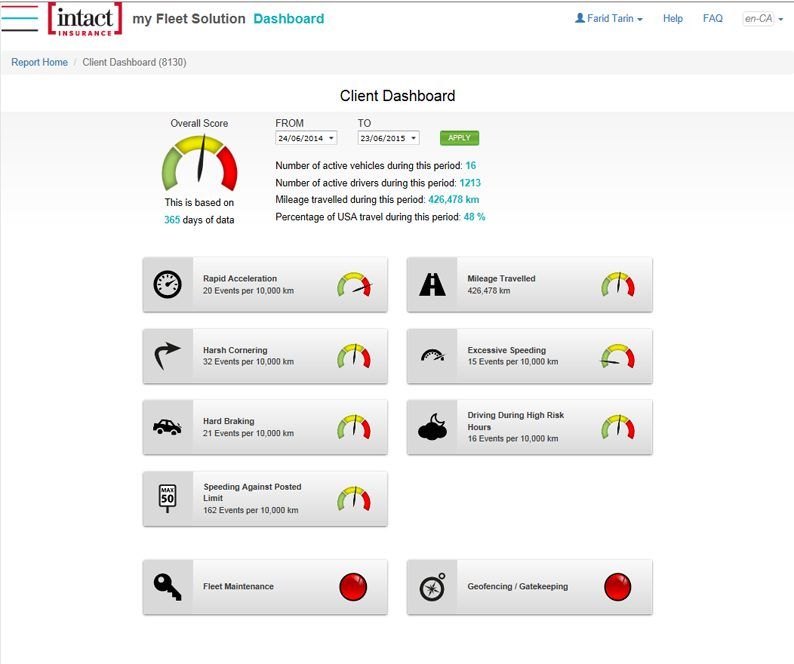

Poor driving behaviors such as idling, speeding, harsh acceleration, and sudden braking contribute to excessive wear and tear on your vehicles, increase fuel costs, .

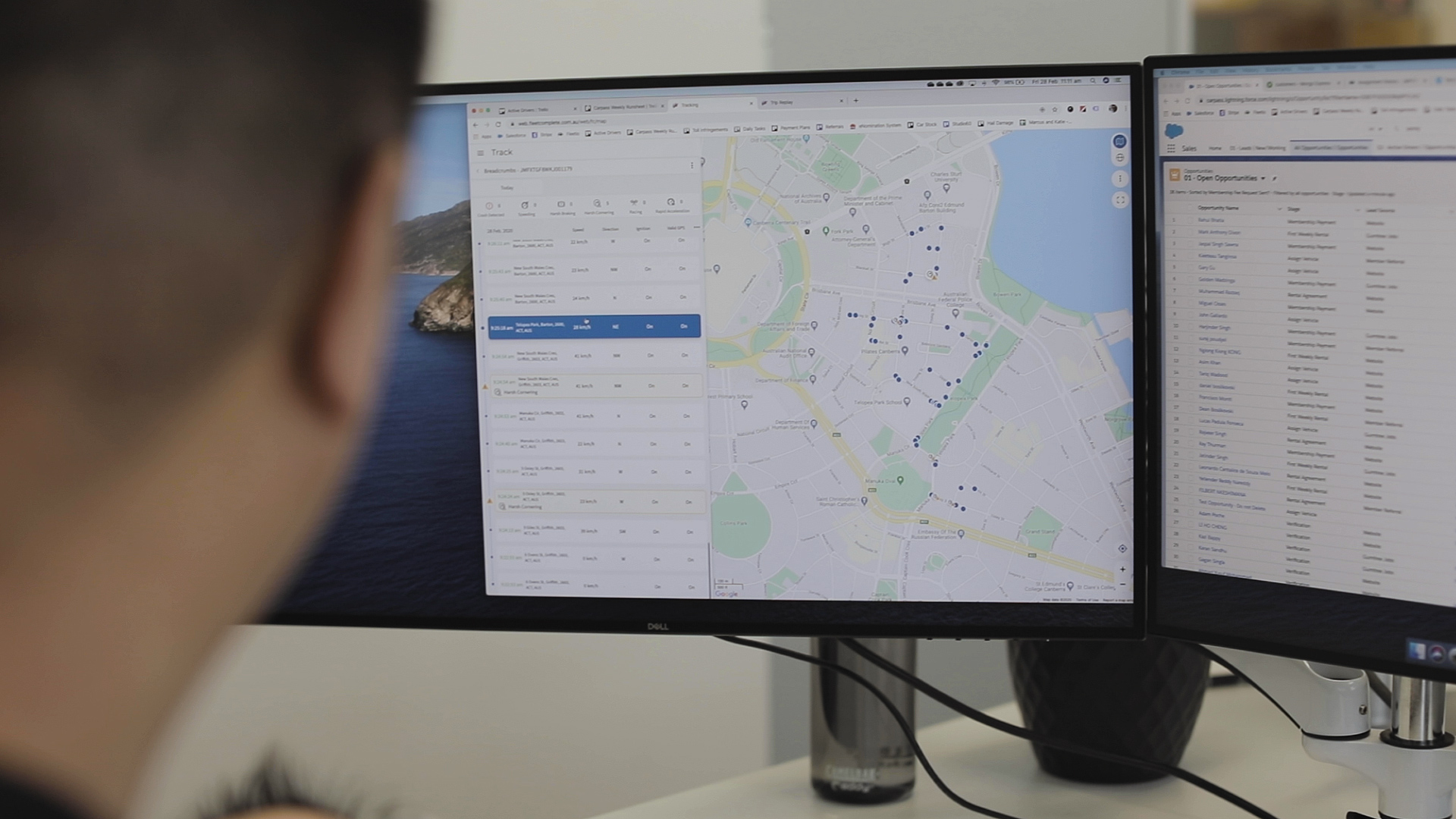

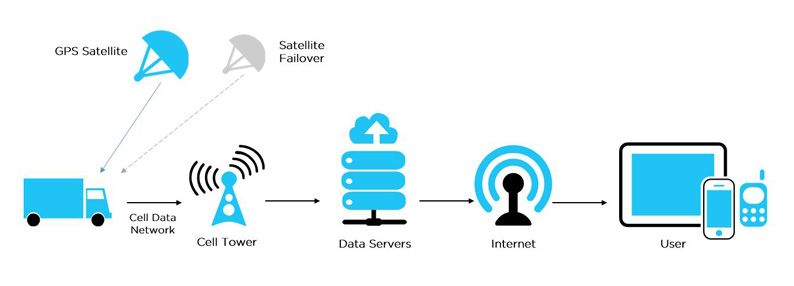

Monitor and control driving behavior by adding a vehicle tracking system to track your drivers and vehicles in real-time. That way, you can identify problems and take corrective actions whenever something goes wrong.

Look for a system that provides not just tracking, but reporting and analytics as well. You should monitor and analyze adherence to planned routes, speed, actual stops and fuel use.

After all, if you don’t measure it, you can’t improve it.

5. Invest in Electric Vehicles

There’s a perception that electric cars are more expensive than those with an ICE. The reality is different. 19 of 40 electric vehicle options available as of this writing have an MSRP lower than $37,000. That’s the average cost of a new car in the United States.

Energy costs for electric vehicles are far less than those for ICE vehicles. According to the US Department of Energy, all-electric vehicles and plug-in hybrid electric vehicles have a typical energy cost of $50–80/month. The typical ICE gasoline costs for a fleet vehicle are easily 10 times that.

Clearly, you could save big on fuel costs annually just by switching from a gas-powered car to an electric car. Yet electric offers even more opportunities for saving.

The total cost of ownership for an electric vehicle is – in many cases – no more than the total costs of ownership of an ICE vehicle. This is partly a function of lower fuel expense and – more pertinent to fleet owners – much lower maintenance costs. Electric vehicles are simpler machines with fewer parts to break down.

Conclusion

The challenge for any fleet manager is to manage costs, reduce expenses, and increase profitability. Follow the best practices shared in this article and – with the right tools – you can make significant improvements to your fleet operations. That can result in compounded savings of both time and money.

What other tips and tricks do you use in your work to reduce costs and boost the bottom line?

If you’d like to find out how Powerfleet (formerly Fleet Complete) can empower your fleet, learn more by requesting our Powerfleet (formerly Fleet Complete) demo.

If you have any questions about Powerfleet’s (formerly Fleet Complete) dashcam solution contact us here.