Insurance premiums are a major expense for any company managing a commercial fleet. These premiums provide protection to companies against accidents and theft.

Unfortunately, the amounts paid out in the event of a claim rarely cover the full cost of the casualty, nor do they solve the issues surrounding the loss of life, revenues or company image.

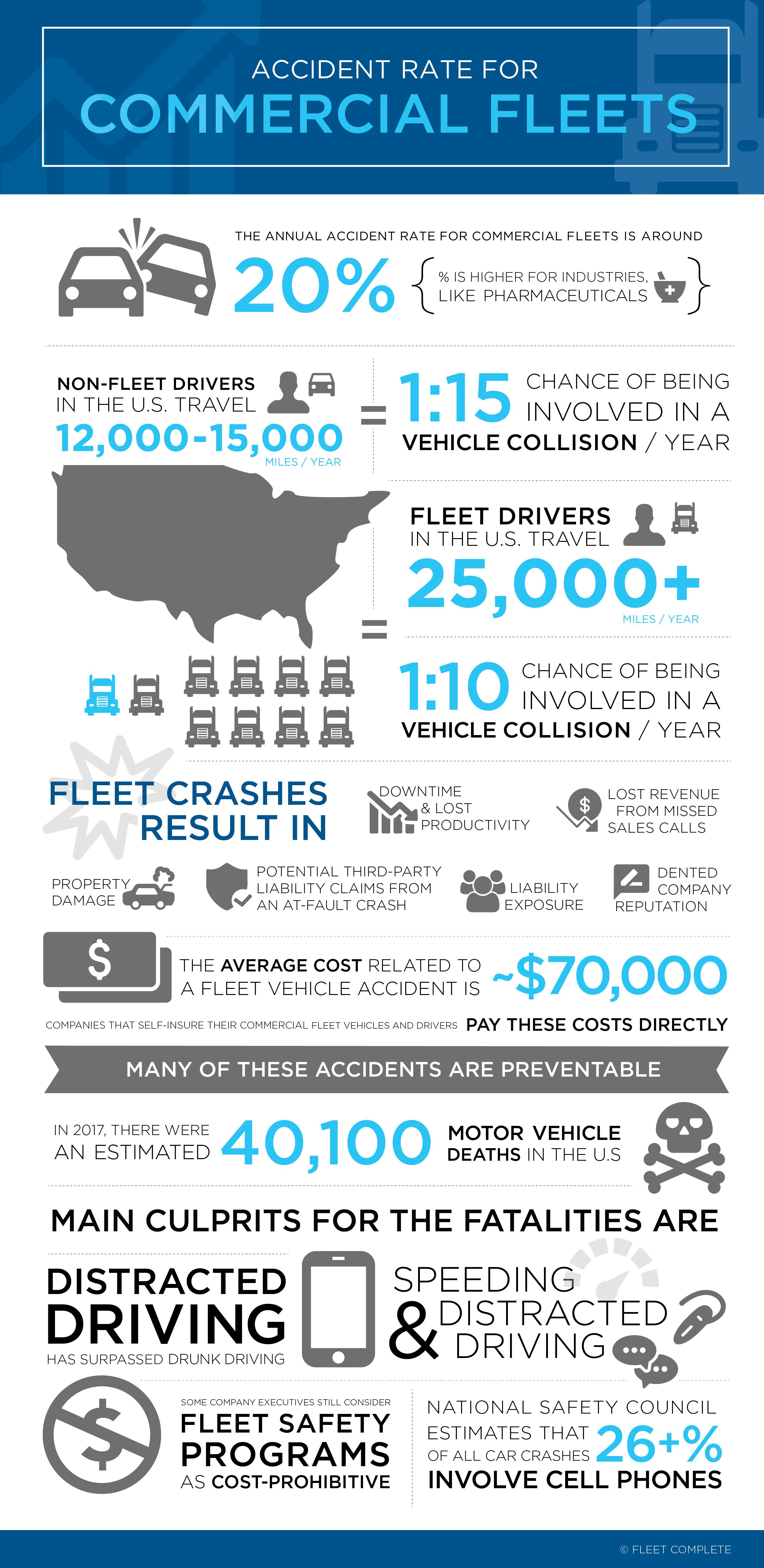

Several years ago, studies showed that the average cost per incident for a commercial fleet was $21,000. These costs include property damage, reduced productivity, missed revenue opportunities and third party liability claims, not to mention the increased insurance premiums.

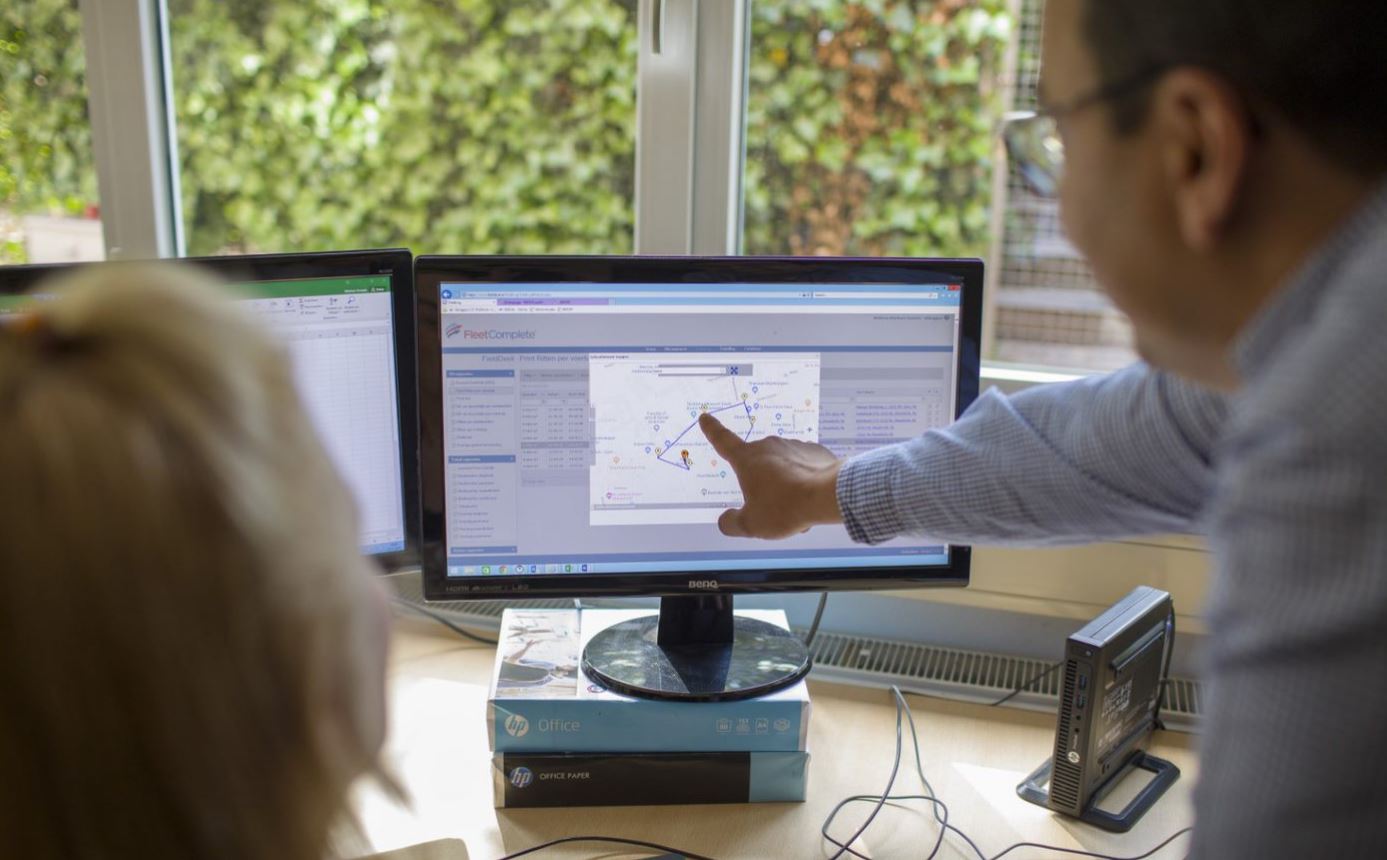

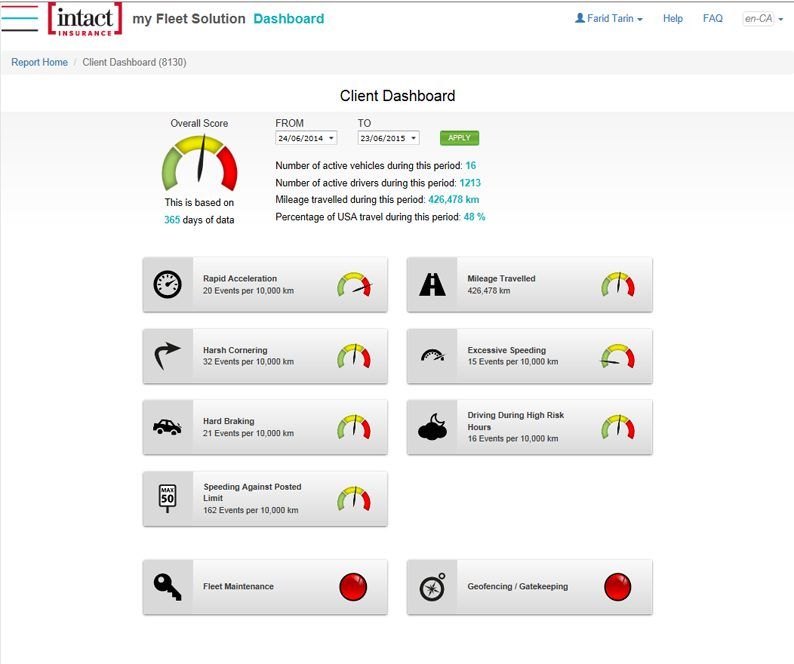

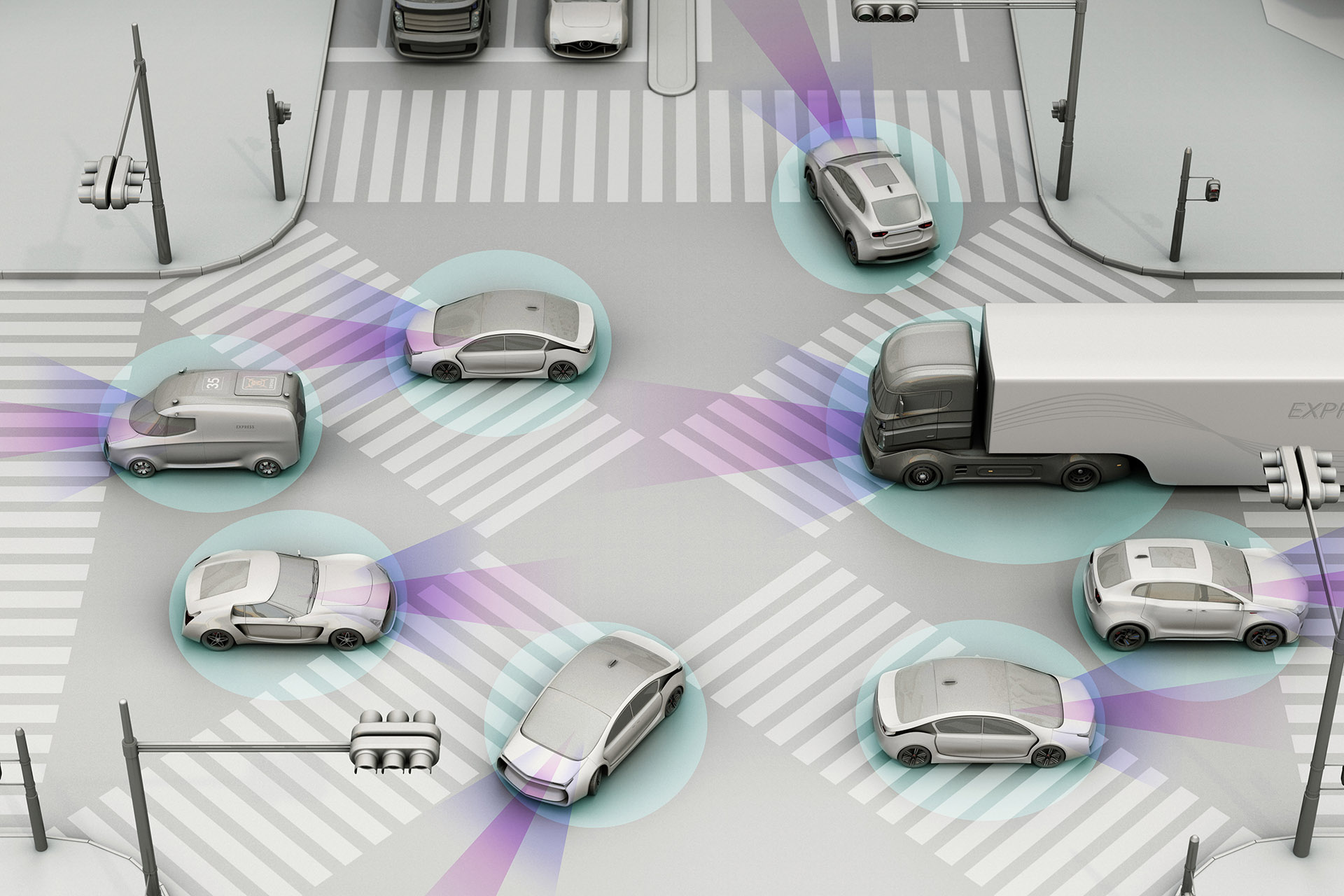

Better driving habits are a key factor in reducing the frequency and severity of claims together with saving on the costs associated with them. Telematics solutions, such as my Fleet Solution from Intact Insurance that use Telus Fleet Tracker to gather key metric data, give fleet managers a better insight into their drivers’ habits and help them intervene and develop policies to better their fleets’ performance.

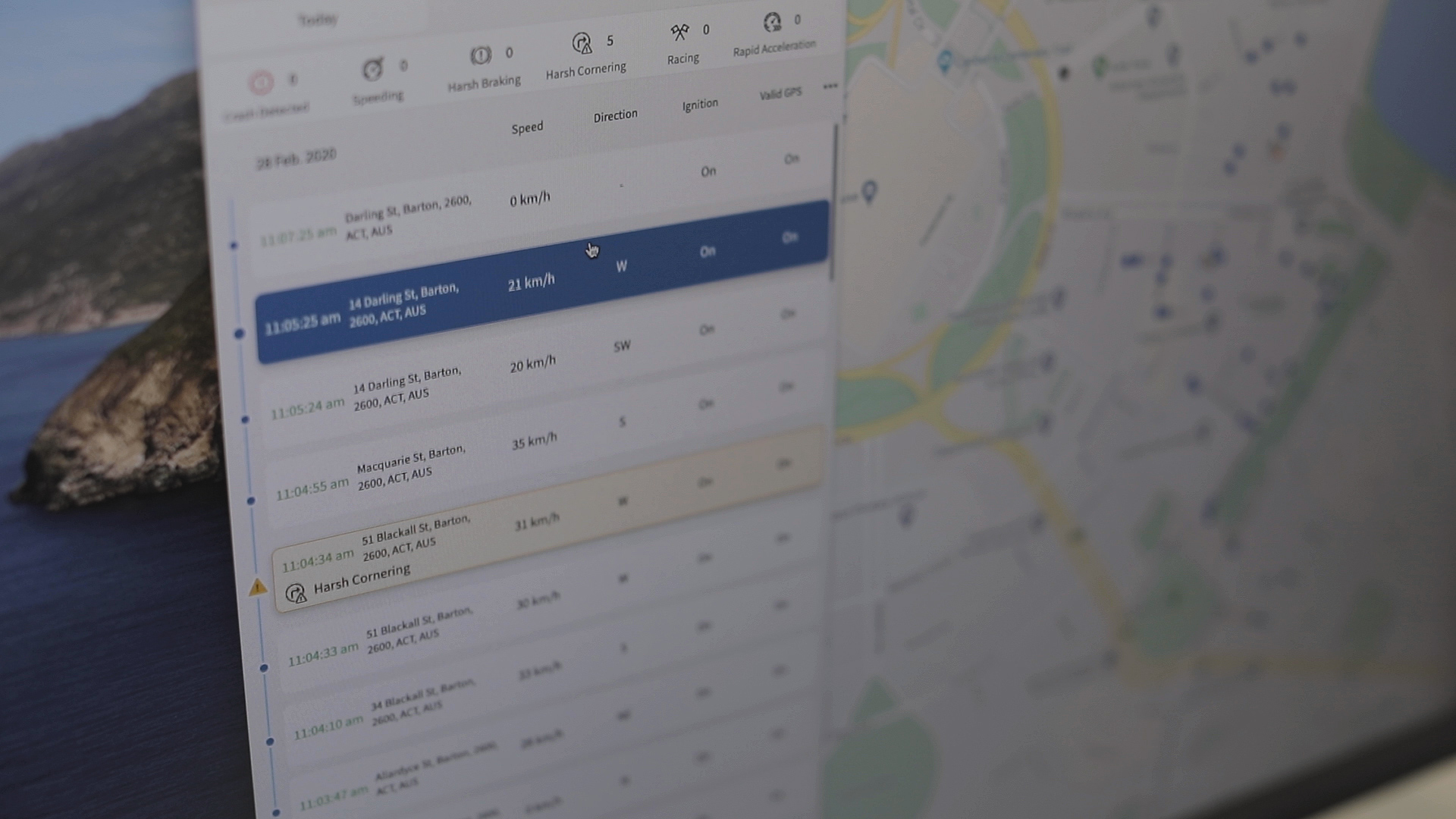

Speeding, one of the events that can easily be tracked and measured using the Telus Fleet Tracker on commercial vehicles, is a major cause of accidents each year. Statistics show that 27% of fatalities and 19% of serious injuries are the result of accidents caused by speeding. Dropping speed by only 1% will reduce the chance of a fatal collision by 5% (OEC-D 2008).

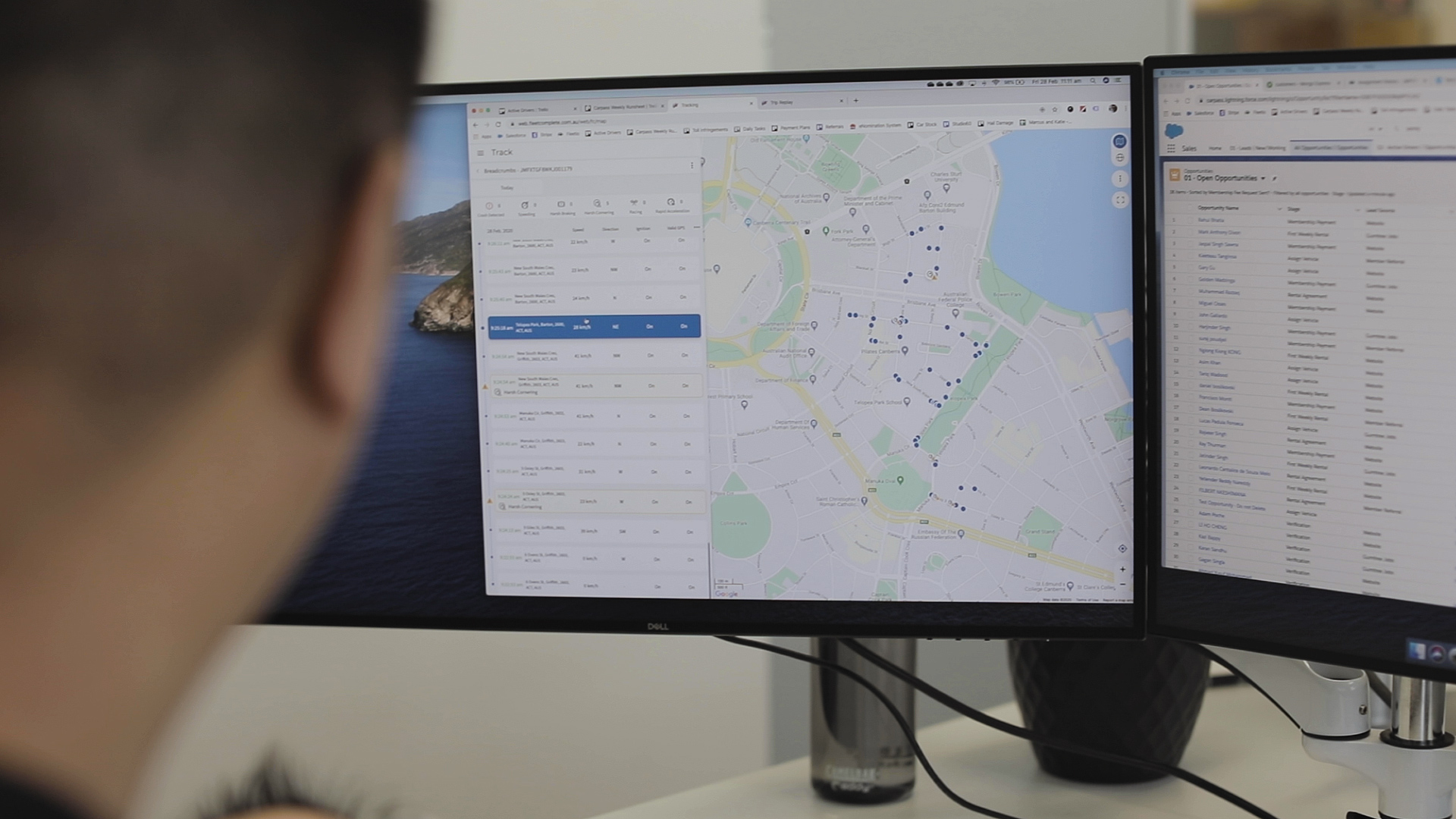

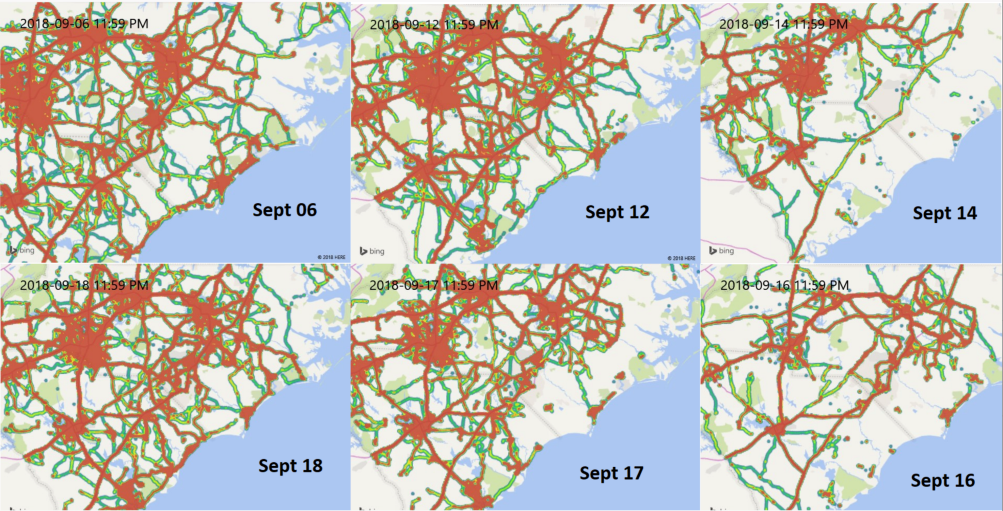

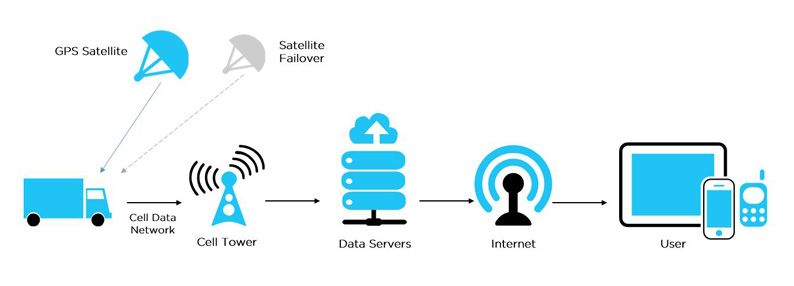

Theft is another major source of insurance claims. Telus Fleet Trackers have built-in GPS tracking that sends instant alerts to managers on any unauthorized use or activated ignition outside of working hours as well as provide authorities with the real-time location of the stolen asset to help bridle theft in its tracks. Companies that make use of fleet trackers have saved thousands of dollars by avoiding claims and eliminating downtime due to missing or stolen equipment.

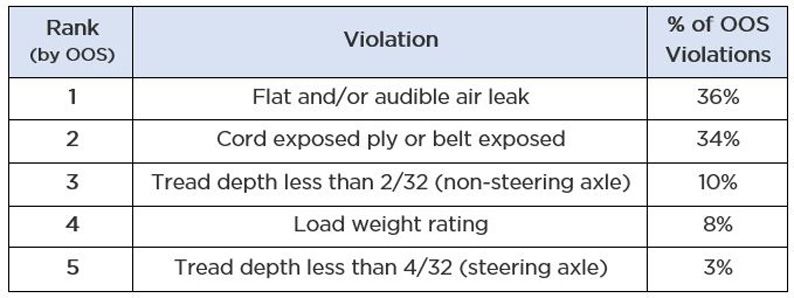

Another important component of the Telus Fleet Tracker solution is the Maintenance module. This management feature allows setting up routine checks, like scheduled oil changes and inspections, to keep your fleet in optimal health. With preventative maintenance, you can reduce those visits that require extensive repairs to your vehicles and ensure that its wearable parts last for as long as possible, helping better manage brake and tire wear. The telematics information gathered by compiling harsh braking and speeding events can also contribute to better driver training, which, in turn, helps you extend the life of brakes and tires.

By using all of the information collected from a telematics solution, fleet managers can educate fleet drivers, improving the overall level of driving skill and safety adherence, boost profitability and reduce operating costs. Whereas with the increased safety, the insurance component will be positively impacted due to reduced claims and provide better stability in premium costs.

For more information on my Fleet Solution, visit intact.ca/business-my-fleet-solution or contact your Intact Insurance broker.